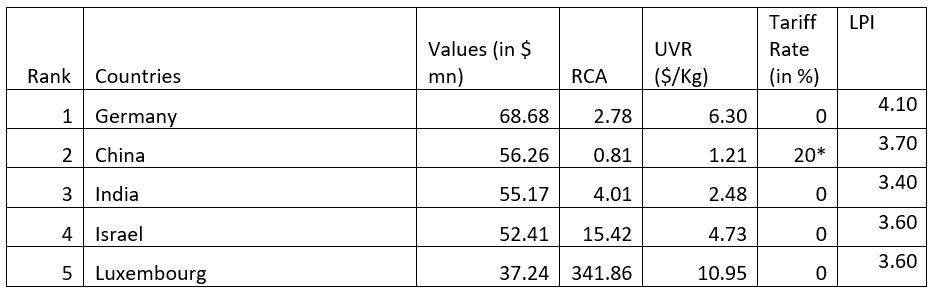

Table1: Key Observations and Trade Statistics on HS-560312- Nonwoven Fabrics (Man-Made Filaments) in CY 2024

Germany leads global nonwoven fabric exports with high-value products and strong logistics.

India and Israel are expanding, with India offering cost-effective alternatives and Israel specialising in premium fabrics.

China remains a major player but faces a 20 per cent US tariff, slightly affecting its low-cost advantage.

Trade policies and logistics efficiency will shape future market dynamics.

Source: TradeMap and F2F Analysis; *Effective from 4th March

Note: RCA – Revealed Comparative Advantage; UVR – Unit Value Realisation; LPI – Logistic Performance Index

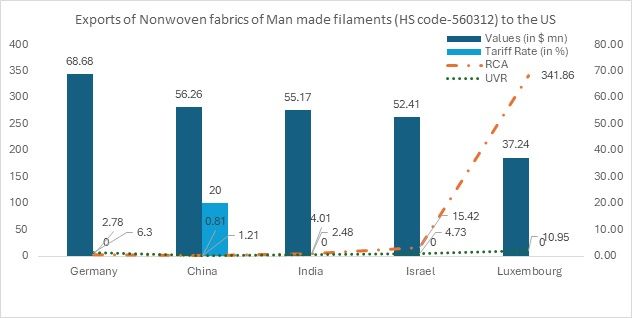

Germany

Germany holds the top position in the export market for nonwoven fabrics of man-made filaments, with a significant export value of $68.678 million to the US. Its Revealed Comparative Advantage (RCA) of 2.78 indicates a strong specialisation in this segment, demonstrating that Germany exports these fabrics at a much higher rate than the global average. This high RCA underscores Germany’s competitive edge, positioning it as a leader in the trade of this product to the US.

Despite offering high-priced products with a Unit Value Realisation (UVR) of $6.30 per kg, Germany maintains its market leadership in the US market. This premium pricing is a result of advanced manufacturing technology, superior quality standards, and stringent regulatory compliance. German manufacturers prioritise innovation, durability, and performance, making their nonwoven fabrics suitable for high-end applications in industries such as automotive, medical textiles, filtration, and geotextiles.

Furthermore, Germany’s dominance is driven by its strong research and development (R&D) ecosystem, which fosters continuous product improvement. Investments in automation, precision engineering, and sustainability initiatives also contribute to its competitive positioning. While higher prices may limit cost-sensitive buyers, Germany’s reputation for reliability and excellence ensures continued demand from premium markets that prioritise quality over cost.

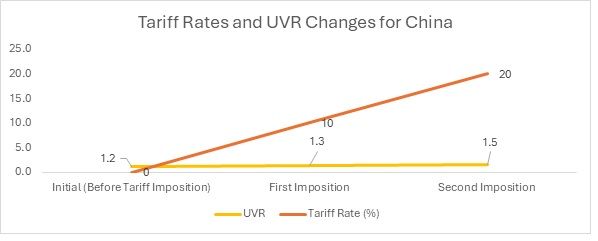

China

China’s position in the nonwoven fabrics of man-made filaments market is a mix of strength and challenge in the US market. With an export value of $56.263 million, the country showcases its large-scale manufacturing capacity, a key factor in maintaining its global presence. However, its RCA of 0.81 per cent suggests that China is losing its competitive edge in this category compared to other leading exporters to the US. An RCA value below 1 indicates that China is less specialised in this segment relative to global trade patterns.

Despite this, China’s low Unit Value Realisation (UVR) of $1.21 per kg allows it to remain a formidable player. A lower UVR implies that China’s pricing strategy is highly competitive, making its products more attractive to cost-sensitive buyers.

Tariff Impact: With the first tariff imposition on February 4th, 2025, the tariff rate increased to 10 per cent. This rise in the tariff burden would lead to an increase in the UVR as production and export costs escalate. As a result, the UVR would likely increase to around $1.3/kg, reflecting the growing challenges posed by the higher tariffs. The increase in the UVR shows that the products are becoming more expensive, which could make them less competitive for price-sensitive US consumers.

In the second tariff imposition, effective from March 4th, 2025, the tariff rate rose further to 20 per cent. This substantial increase would push the UVR to approximately $1.5/per kg or higher. The higher tariff burden will continue to raise costs, further diminishing the cost-effectiveness of the products. However, it is important to note that despite the tariff imposition, China does not entirely lose its cost advantage. India, which has the capacity to compete with China, is still behind in terms of UVR.

India

India stands as a strong contender in the nonwoven fabrics of man-made filaments market, with exports totalling $55.174 million to the US. Its RCA of 4.01 underscores its significant specialisation in this category, making it one of the most competitive global players. This high RCA value indicates that India’s share in the global nonwoven fabrics trade is much larger than its overall participation in world exports, reflecting a strong foothold in the industry.

India’s growing textile manufacturing ecosystem, supported by robust government policies, infrastructure development, and increasing investments, plays a key role in strengthening its presence in nonwoven fabric exports.

India’s moderate UVR of $2.48 per kg positions it as an affordable supplier in the global market. Unlike Germany, which focuses on premium, high-tech products, India competes on a balance between price and quality, making it attractive for buyers looking for cost-effective solutions without compromising too much on performance.

Logistics Performance & Challenges: India has an above-average Logistics Performance Index (LPI) score of 3.4, highlighting its improving trade facilitation, infrastructure, and customs efficiency. However, it still lags behind Luxembourg, which has a slightly higher LPI of 3.6. While India has made significant progress in logistics efficiency, further improvements are needed in areas such as:

- Reducing port congestion and streamlining customs clearance for faster exports.

- Enhancing last-mile connectivity through better transportation networks.

- Investing in digitisation and automation to improve supply chain visibility and efficiency.

By addressing these logistical bottlenecks, India can further strengthen its position in the global nonwoven fabrics market, boosting export volumes and competitiveness.

Bottom of Form

Israel

Israel has carved out a strong position in the global nonwoven fabric market, with exports reaching $52.414 million to the US. Its exceptionally high RCA of 15.42 underscores its specialisation in this category, making it a key player in high-value, specialised textile products.

A UVR of $4.73 per kg highlights the premium nature of Israel’s exports to the US, which are widely used in medical, industrial, defence, and high-tech applications. Unlike mass producers such as China and India, Israel focuses on quality, innovation, and advanced material development, ensuring strong demand in markets that prioritise performance over cost.

Additionally, Israel’s efficient logistics performance and strategic trade agreements facilitate seamless exports, keeping it competitive against other leading nations. Going forward, the country’s success in this segment will depend on continued investment in R&D, market diversification, and sustainability initiatives to maintain its technological edge and premium market positioning.

Luxembourg

Despite being a relatively small player in the global textile export market, Luxembourg exhibits a staggering RCA of 341.86 in nonwoven fabric exports. This exceptionally high RCA signifies that Luxembourg’s share in global nonwoven fabric exports is disproportionately higher than its overall participation in world trade, highlighting the country’s strong specialisation in this segment.

Targeted investments in high-value nonwoven fabrics: Luxembourg’s nonwoven fabric industry has increasingly focused on high-performance textiles, catering to specialised applications such as filtration, automotive, construction, and medical textiles. These sectors demand precision engineering and advanced material science, areas in which Luxembourg has developed a competitive edge.

Premium positioning: Luxembourg’s UVR of $10.95 per kilogram significantly exceeds the global average for nonwoven fabrics to the US. This premium pricing reflects the export of high-tech, performance-driven nonwoven products rather than commodity-grade textiles. The country’s focus on low-volume, high-margin markets ensures profitability despite relatively smaller absolute export volumes.

Leveraging European market integration & logistics strengths: As a centrally located European nation, Luxembourg benefits from efficient logistics and connectivity to major industrial hubs across the EU. This enables seamless supply chain operations and facilitates the export of high-value nonwoven fabrics to key European markets.

Luxembourg’s remarkable RCA of 341.86 and UVR of $10.95/kg underscore its strategic positioning as a leader in specialised nonwoven fabrics. With continued investments in R&D, sustainability, and high-value manufacturing, the country is well-poised to maintain its competitive advantage in this dynamic segment of the textile industry.

Outlook and conclusion

Germany remains the undisputed leader in nonwoven fabric exports, backed by its high export value and superior trade infrastructure. The country’s Logistics Performance Index (LPI) of 4.10 further strengthens its competitive edge, ensuring seamless global trade.

India and Israel are expanding their market presence, demonstrating consistent growth rates in exports. India, with a strong RCA of 4.01 and a UVR of $2.48/kg, balances volume with value-driven exports. Meanwhile, Israel stands out with an RCA of 15.42 and a UVR of $4.73/kg, indicating a specialisation in high-value nonwoven fabrics.

China, despite being a major exporter, relies on high-volume, low-cost production, as reflected in its UVR of $1.21/kg. However, since an additional 20 per cent tariff is imposed by the US, China’s competitiveness could be only slightly affected, due to its significant lesser UVR, making it cost effective even in case of additional tariffs.

As of January 1, 2025, all five countries discussed here benefited from a zero-tariff rate, ensuring unhindered international trade. Apart from Germany’s leading LPI, the other exporters—China, India, Israel, and Luxembourg—maintain competitive LPIs ranging from 3.40 to 3.70, highlighting their growing trade efficiency.

Overall, the nonwoven fabric export landscape is evolving, with Germany maintaining dominance while India and Israel are gaining traction. Any shifts in trade policies, such as tariff hikes on China, would only result in a larger contribution of other countries volume-wise but they would have to level up in terms of prices to match China’s dominance.

Fibre2Fashion News Desk (NS)