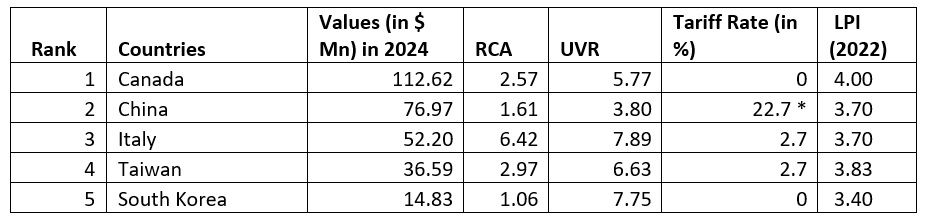

Table 1: Key Exporting Countries and Trade Statistics- HS-590310– PVC-Coated Fabrics for CY 2024

Canada leads US PVC-coated fabric imports with $112.62 million in 2024, benefiting from zero tariffs.

China, the second-largest supplier, remains competitive despite a 22.7 per cent tariff, with the lowest UVR at $4.56/kg.

Italy dominates the premium market, while South Korea gains from duty-free access.

China’s cost advantage remains strong despite the recent hike in tariff by the US.

Source: TradeMap and F2F Analysis * Effective from 4th March

Note: RCA – Revealed Comparative Advantage; UVR – Unit Value Realisation; LPI – Logistic Performance Index.

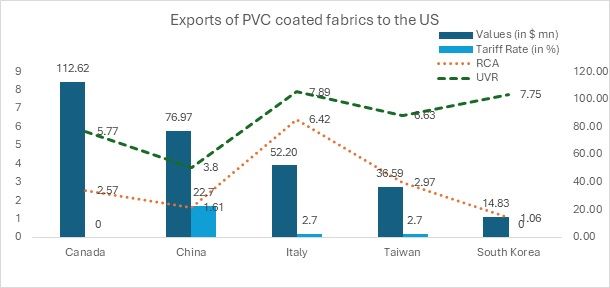

Figure 1: Key Exporting Countries and Trade Statistics- HS-590310– PVC-Coated Fabrics for CY 2024

The global trade of PVC-coated fabrics is influenced by production costs, technological advancements, and environmental regulations. The key players in the US market include Canada, China, Italy, Taiwan, and South Korea.

Canada

Canada stands as the leading exporter of PVC-coated fabrics to the US, recording an impressive export volume of $112.618 million in 2024. This leadership position is reinforced by its competitive pricing strategy, maintaining an RCA of 2.57, which enhances its attractiveness in international markets.

Canada’s proximity to the US, combined with its high Logistics Performance Index, makes it a probable leader in the category compared to Italy and Taiwan. Canada benefits from free market access in the US under the USMCA, enabling cost-effective trade and improved market access. These tariff advantages provide Canadian exporters with a strategic edge, fostering greater demand and reinforcing their dominance in the industry.

China

China ranks as the second-largest exporter of PVC-coated fabrics to the US, with an export volume of $76.969 million. Despite trailing Canada in volume, China offers the most competitive pricing at $3.80 per kg, making it a preferred choice for bulk buyers seeking cost-effective solutions.

Until the beginning of this year, China’s exports were competitive with RCA of 1.61 and a 2.7 per cent tariff, which slightly affected its price advantage compared to tariff-free competitors. Nonetheless, its low production costs and large-scale manufacturing capabilities continue to drive strong global demand.

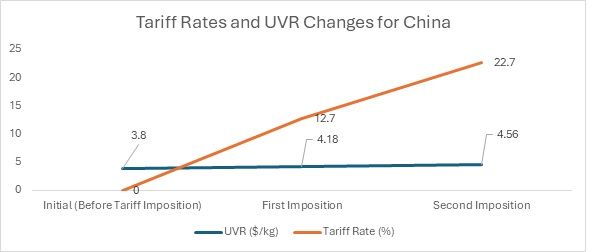

Tariff Impact: With the first round of tariff imposition by the US on February 4th, 2025, the tariff rate increased to 12.7 per cent. This rise in the tariff would lead to an increase in the UVR as export costs escalate. As a result, the UVR would likely increase to around $4.18/kg, reflecting the growing challenges posed by the higher tariffs imposed by the US. The increase in the UVR shows that the products are becoming more expensive, which could make them less competitive for price-sensitive consumers.

In the second tariff imposition, effective from March 4th, 2025, the tariff rate rose further to 22.7 per cent. This substantial increase would push the UVR to approximately $4.56/kg or higher. The higher tariff will continue to raise costs, further diminishing the cost-effectiveness of the products. However, in the case of PVC-coated fabrics, China still happens to be the country with the lowest UVR, indicating China’s steady hold in the supply of low-cost PVC-coated fabrics to the US.

Italy

Italy secures a premium market position in the global PVC-coated fabric trade, exporting $52.202 million. Unlike price-driven competitors, Italy emphasises high-quality and specialised fabrics, reflected in its highest unit price of $7.89/ kg.

However, Italian exports face a 2.7 per cent tariff, which affects cost competitiveness in markets where tariffs apply. Despite this, Italy’s reputation for superior craftsmanship and innovation sustains its strong demand among US buyers prioritising quality over price.

Taiwan

With exports totalling $ 36.591 million in 2024, this market player maintains a mid-range pricing strategy at $6.63/ kg, striking a balance between affordability and quality. The country has a competitive RCA of 2.97.

While a 2.7 per cent tariff impacts competitiveness, it does not pose a significant barrier to trade. The steady demand for its products suggests a resilient market position supported by a balance of pricing and quality considerations.

South Korea

As the smallest exporter among the top five, this country shipped $ 14.834 million of PVC-coated fabrics in 2024. However, it stands out with an RCA of 1.06, making it highly competitive in price-sensitive markets.

Additionally, benefiting from a zero-tariff market access, it gains an edge in duty-free zones, enhancing its cost attractiveness. This strategic advantage positions it as a strong contender in budget-conscious segments of the global market.

Competitive landscape and future outlook

Competitive Pricing Strategy: China and South Korea offer the lowest prices, making them favourable for cost-sensitive buyers. However, Italian products command premium pricing, indicating strong brand value and quality differentiation.

Tariff Considerations: Canada and South Korea benefit from a zero per cent tariff market access in the US, giving them an edge over Italy, China, and Taiwan (now 22.7 per cent), which face a 2.7 per cent tariff.

Quality vs. Cost Trade-off: US buyers looking for high-end, durable products should consider Italy, whereas bulk purchasers focusing on cost should explore South Korea and other countries.

Future Market Trends: Sustainability concerns may drive demand for eco-friendly PVC alternatives, influencing trade dynamics and production methods.

Conclusion

The market for HS-590310 PVC-coated fabrics in the US is influenced by pricing, trade policies, and quality preferences. While Canada leads in export volume, China and South Korea have traditionally held a competitive edge in cost, whereas Italy dominates the premium segment. With the recent imposition of a 20 per cent additional tariff on Chinese exports by the U.S., China’s cost advantage will not be affected and will not create a gap to lower cost options. However, China’s influence within the region might decrease, which will lead to an increase in volume from countries such as Canada and South Korea.

Fibre2Fashion News Desk (NS)