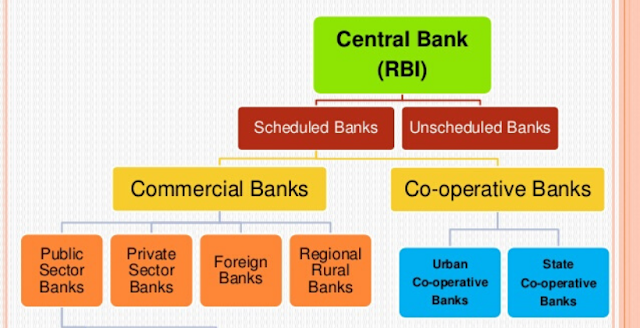

Which is registered in the second schedule of the reserve

bank of India 1934. It includes these banks, which have a paid-up capital and

reserve of an aggregate value of not less than 5 lakh and must satisfy the

criteria laid down under section 46(6)(a) of the act.

bank of India 1934. It includes these banks, which have a paid-up capital and

reserve of an aggregate value of not less than 5 lakh and must satisfy the

criteria laid down under section 46(6)(a) of the act.

These are the banks where more than 50% stake is held by the

government.

government.

Example : Bank of Baroda, Bank of India, Indian bank.

Non-Scheduled bank

Its means a banking company as define in clause (c) of

section 5 of the banking regulation act 1949 (10 of 1949), which is not a schedule

bank. Banks with reserve capital of less than 5 lakh qualify as non-schedule

bank, these banks are not governed by according to the RBI act they receive no benefit

from the RBI.

section 5 of the banking regulation act 1949 (10 of 1949), which is not a schedule

bank. Banks with reserve capital of less than 5 lakh qualify as non-schedule

bank, these banks are not governed by according to the RBI act they receive no benefit

from the RBI.

Cooperative banks

A co-operative bank is a financial entity that belongs to

its members, is at the same time the

owners and the customers of their bank. Co-operative banks are often created by

persons belonging to the same local or professional community or sharing a

common interest. Co-operative banks generally provide their members with a wide

range of banking and financial services ( loans, deposits, banking account ).

its members, is at the same time the

owners and the customers of their bank. Co-operative banks are often created by

persons belonging to the same local or professional community or sharing a

common interest. Co-operative banks generally provide their members with a wide

range of banking and financial services ( loans, deposits, banking account ).

· Cooperative

banking institutions takes DEPOSITS and LEND MONEY in most parts of the world

banking institutions takes DEPOSITS and LEND MONEY in most parts of the world

· It differs

from STOCKHOLDERS BANK.

from STOCKHOLDERS BANK.

· Follows

all PRUDENTIAL banking regulations.

all PRUDENTIAL banking regulations.

· It provides

FINANCIAL ASSISTANCES to the people with small means to protect them from the

debt trap of the money lenders.

FINANCIAL ASSISTANCES to the people with small means to protect them from the

debt trap of the money lenders.

· Its often

created by a person belonging to the same local or personal community or sharing

a common interest.

created by a person belonging to the same local or personal community or sharing

a common interest.

· Wide range

of banking and financial and financial services, ( LOANS, DEPOSITS, AND BANKING

ACCOUNTS ETC…).

of banking and financial and financial services, ( LOANS, DEPOSITS, AND BANKING

ACCOUNTS ETC…).

Central cooperative banks

These are the federations of the credit societies in a

district.

district.

The funds of the bank consist of share capital, deposits,

loans and overdrafts from state co-operative banks and joint stocks.

loans and overdrafts from state co-operative banks and joint stocks.

They also conduct all the business os a stock bank.

State cooperative banks

The state cooperative bank is a federation of central

co-operative bank and acts as a watchdog of the co-operative banking structure

in the state.

co-operative bank and acts as a watchdog of the co-operative banking structure

in the state.

Its funds are obtained from share capital, deposits, loans

and overdrafts from the reserve bank of India.

and overdrafts from the reserve bank of India.

The state cooperative banks lend money to central

co-operative banks and primary societies and not directly to the farmers.

co-operative banks and primary societies and not directly to the farmers.

They also know as apex banks.

Example : Andhra Pradesh state co-operative bank Ltd, the

Bihar state bank Ltd, Chhatisgarh rajaya sahakari bank maryadit, the goa state

co-operative bank Ltd, the Gujarat state co-operative bank Ltd.

Bihar state bank Ltd, Chhatisgarh rajaya sahakari bank maryadit, the goa state

co-operative bank Ltd, the Gujarat state co-operative bank Ltd.

Indian bank

Indian banks are those banks, which are incorporated in

India.

India.

Commercial bank

A commercial bank is a type of bank / financial institution

that provide services such as accepting deposits, making business loans, and

offering basic investment products.

that provide services such as accepting deposits, making business loans, and

offering basic investment products.

The commercial bank established with an objective to help

businessmen. These banks collect money from the general public and give short-term

loans to businessmen by way of cash credits. Overdrafts, etc.

businessmen. These banks collect money from the general public and give short-term

loans to businessmen by way of cash credits. Overdrafts, etc.

Example : ICICI Bank, state bank of India, axis bank, and

HDFC Bank.

HDFC Bank.

Public sector bank

PUBLIC SECTOR BANKS (PSBs) are banks where a majority stake

( more than 50% ) is held by a government. The share of these banks is listed

on stock exchanges. There are a total of 21 PSBs in India.

( more than 50% ) is held by a government. The share of these banks is listed

on stock exchanges. There are a total of 21 PSBs in India.

The central government entered the banking business with the

nationalization of the imperial bank of India in 1955.

nationalization of the imperial bank of India in 1955.

A 60% stake was taken by the RESERVE BANK OF INDIA and the

new bank was named as the STATE BANK OF INDIA. The next major nationalization of

banks took place in 1969 nationalization of an additional 14 major banks.

new bank was named as the STATE BANK OF INDIA. The next major nationalization of

banks took place in 1969 nationalization of an additional 14 major banks.

The total deposits in the banks nationalized in 1969 amounted

to 50 crores. This move increased the presence of nationalized banks in India. With

84% of the total branches coming under government control.

to 50 crores. This move increased the presence of nationalized banks in India. With

84% of the total branches coming under government control.

The next round of nationalization took place in April

1980. The government nationalized six banks. The total of these banks amounted

to around 200 crores. This move led to a further increase in the number of

branches in the market. Increasing to 91% of the total branch network of the

country.

1980. The government nationalized six banks. The total of these banks amounted

to around 200 crores. This move led to a further increase in the number of

branches in the market. Increasing to 91% of the total branch network of the

country.

Example : state bank of India, Punjab national bank, bank of

Baroda, Canara Bank, Andhra bank, syndicate bank, state bank of Mysore, bank of

Maharashtra.

Baroda, Canara Bank, Andhra bank, syndicate bank, state bank of Mysore, bank of

Maharashtra.

Regional rural banks

RRBs are oriented towards meeting the needs of the weaker

sections of the rural population consisting of small & marginal farmers,

agricultural laborers, artisans & small entrepreneurs.

sections of the rural population consisting of small & marginal farmers,

agricultural laborers, artisans & small entrepreneurs.

As these banks were more suitable for rural development

work, preference should be given to them to open branches in rural banks.

work, preference should be given to them to open branches in rural banks.

The eligible business of commercial banks rural branches may

be transferred to RRBs.

be transferred to RRBs.

The losses in initial years of RRBs may be met by

shareholders & equity capital should also be raised.

shareholders & equity capital should also be raised.

The various facilities provided by sponsor banks should

continue for 10 years in each case.

continue for 10 years in each case.

Concessionary refinance by RBI should be continued.

The control, regulatory and promotional responsibilities

relating to RRBs should be transferred from the government of India to RBIs or

NABARD.

relating to RRBs should be transferred from the government of India to RBIs or

NABARD.

Example: Gorakhpur kshatriya Gramin bank, Haryana kshatriya

Gramin bank Bhiwani, Jaipur-Nagpur anchalik Gramin Bank Jaipur.

Gramin bank Bhiwani, Jaipur-Nagpur anchalik Gramin Bank Jaipur.

Private sector bank

Private sector banks refer to the banks whose majority of the stake is held by individuals and corporations.

Private banks should be established as public limited

companies under the Indian Companies Act 1956.

companies under the Indian Companies Act 1956.

Paid-up capital >300 crores.

The promoters’ share shall not be less than 40 percent.

The voting rights of a shareholder shall not exceed 10 percent.

Banks are required to observe priority sector lending

targets.

targets.

Eight banks were

set-up in the private sector and some mergers took place.

set-up in the private sector and some mergers took place.

Example : ICICI Bank, yes bank, IndusInd Bank, Kotak Mahindra

bank, axis bank.

bank, axis bank.

Foreign banks in India

Foreign banks are those banks, which are incorporated in

foreign country.they have set-up their branches in India.

foreign country.they have set-up their branches in India.

The first foreign bank to start its operation in India was a standard chartered bank in 1858. The second bank was CITI bank which started in

1902.

1902.

There are over 29 foreign banks that operate in India.

Foreign banks are also known for uprooting the unemployment

in India by offering a lot of job opportunities.

in India by offering a lot of job opportunities.

These banks have brought along with them the latest technologies

and banking practices.

and banking practices.

EXAMPLE: Royal Bank of Scotland, Switzerland’s UBS, US-based

GE Capital, industrial and commercial bank of china.

GE Capital, industrial and commercial bank of china.