In these fast-moving times, convenience and quickness are crucial, more so in road travel. The wait at toll booths makes it even worse because each minute that passes is a waste. To tackle this issue, the Government of India introduced the Fastag system. By incorporating fast and convenient toll transactions, it also facilitates quick toll pass and recharge. What is FasTag, and how does it work? Let’s get into details.

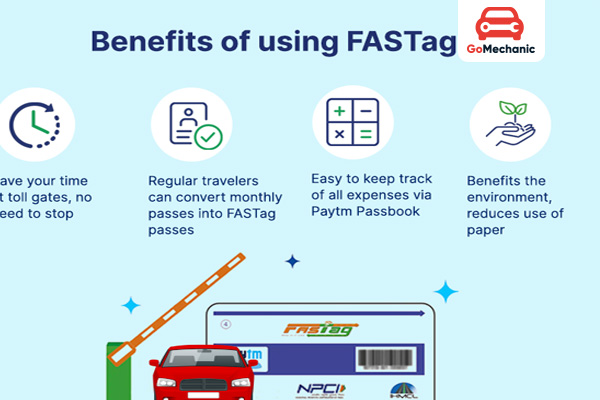

What is Fastag? Benefits of FASTag

The FASTag is an automated toll collection system that essentially makes the vehicle pass the toll plaza without stopping for any kind of payment. There is about a monthly toll pass recharge mechanism whereby FASTag is a sticker or radio-frequency identification and is supposed to be placed in the lower-middle area of the windshield of on a vehicle linked to a prepay account where automatically through scanning of the tag, the fees are deducted. The whole-hearted efforts of the NHAI ultimately enhance travelling experience on national highways

1. Rationales for Saving Time at Toll Booths: FASTag users drive through their own lanes, thus allowing speedy passage through toll booths with little or no stoppage for payments.

2. Convenient: Cash and coins are no longer required as the entire toll fee structure is now an automatic and hassle-free process.

3. Cashless Transaction: Provides a way for toll payments to be made safely while doing away with the horrible cash burden of dealing in notes.

4) Major Reduction in Traffic Congestion: With no stoppage of FASTag-carrying vehicles,traffic flow at toll plazas improves and mad congestion decreases.

5) Fuel Efficiency: Less idling at toll booths means less fuel consumption, a double advantage.

6) Toll Discounts: Some tolls offered discounts for FASTag users, thus reducing the overall costs of traveling.

7) Simple Recharge Methods: Recharging a FASTag is simple, done online through multiple channels, and an undisrupted travel experience ensues.

To understand more, Check this out FASTag Explained: Everything You Need to Know

Monthly Toll Pass Recharge: How to Use and Recharge FASTag

How to Get a FASTag Monthly Pass

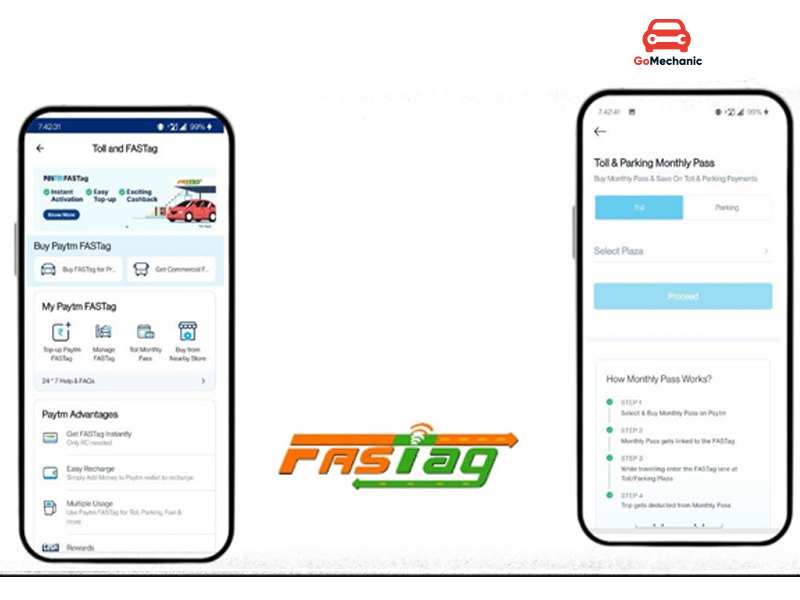

A simple step guide to getting a buy monthly FASTag pass to smooth your toll payments. Getting the idea about how the monthly FASTag pass is enrolled should have you trying to equip yourself with whatever is required for a hassle-free trip to any highways in India. Online recharge for FASTags monthly pass can renew FASTag on monthly basis sitting comfortably at home or at work.

- Purchase Application for FASTag

For the FASTag monthly pass, users should first get the FASTag sticker for their vehicle. This can be obtained through authorized banks, online, or designated toll plazas. FASTag stickers must to be carefully placed on the windshield of the vehicle following the provided guidance.

Registration of the online pass fastag on respective bank or on issuer website has to be carried out after affixing FASTag on the vehicle. The registration requires submission of particulars relating to vehicle and owner, along with KYC documents as stipulated in the regulations. The FASTag is then linked to a prepaid account from which toll charges will be deducted.

After successful registration and linking, users can opt for a FASTag monthly pass by accessing the appropriate option on the website or mobile app of the issuer. They can select the duration of the pass and recharge the prepaid account in advance to activate the monthly pass feature.

How To Recharge Your FASTag

You can recharge in several ways:

- Online Banking: Log into your bank’s website or app, select the FASTag recharge option, and confirm the amount.

- Bank Mobile App: Use the bank’s app to quickly recharge by entering the amount.

- Payment Apps: Recharge via Paytm, PhonePe, or Google Pay by entering your FASTag number and amount.

- Physical Recharge: Visit a toll plaza or bank branch to add funds directly using cash or card.

- Auto Top-Up: Set up automatic recharge for when your balance falls below a threshold.

Here are the essential points to know about FASTag Recharge:

1. Determine How Much to Recharge

- Estimate Usage: Recharge based on how often you use toll roads and your usual toll costs.

- Minimum Balance: There is no minimum balance amount. Some providers may require a minimum recharge of ₹100 or ₹200 for smooth operations.

2. Monitor Your Balance

- Balance Alerts: You’ll receive SMS or app notifications when your balance is low or when a toll is deducted.

- Balance Check: Use your bank’s app or website to check your balance anytime.

3. Refill at Toll Plazas if Needed

- On the Go: If your balance runs low, you can recharge directly at the toll plaza using cash or a card.

4. Keep Sufficient Funds

- Avoid Interruptions: Ensure there’s always enough balance for a smooth toll payment experience. Auto top-up can help avoid any issues.

5. Enjoy Uninterrupted Travel

With your FASTag properly recharged, you can pass through tolls without any delays, making your journey faster and more convenient.

Hence, this summarizes the procedure for getting your monthly toll pass recharge through FASTag

A Monthly Pass FASTag for Frequent Travellers

The Monthly-pass FASTag is truly an essential for those who are frequent highway travellers. It makes travelling through several toll plazas hassle-free and smooth, hence the most sought-after by people commuting very often for either work or personal reasons.

How to Choose the Best Monthly Pass FASTag

While choosing a Monthly Pass FASTag, one needs to consider:

- Frequency on route: One may choose the pass covering most of the toll plazas frequented by him/ her.

- Validity of Pass: Check whether the pass validity is suitable for one’s travel.

- Comparative costing: Is it worth it to buy the pass according to travel frequency?

Brief Overview of Different FASTag Providers

- SBI FASTag: Offers monthly FASTag passes, having route planners and toll calculators through its online portal to assist you in your travel cost management.

- HDFC Bank FASTag: Monthly FASTag passes allow for quick and simple online recharging through their net banking platform or mobile app.

- Paytm FASTag: This offers a monthly FASTag pass seamlessly connected with its popular mobile wallet so that recharging is even easier on the go.

- Axis Bank FASTag: Online passes fastag supported by real-time balance updates and transaction history through online banking system.

Check this out FASTag KYC Update Online: Step Guide for Indian Drivers

Conclusion: Is FASTag the Future of Seamless Toll Payments?

In conclusion, FASTag offers a simple and efficient way to handle toll payments with its easy recharge options. Whether you choose online banking, mobile apps, third-party platforms, or physical recharges, adding funds to your FASTag is hassle-free. The system streamlines travel by automatically deducting toll fees,saving time, and reducing congestion. By keeping your account balanced and utilizing the convenient recharge facilities, FASTag ensures a smooth, cashless travel experience every time you hit the road

FAQ’s

- Question: What is the minimum recharge amount required for FASTag?

Answer: There is no minimum balance requirement however minimum recharge amount for Fastag Wallet is Rs 100.

2. Question: Is FASTag free?

Answer: State Bank of India offers FASTag without charging tag fees or security deposits for cars, jeeps, vans, Tata Aces, and other compact light commercial vehicles. However, a minimum balance of ₹200 is required for FASTag activation.

3. Question: Can I use FASTag without a sticker?

Answer: FASTag stickers are mounted to the windscreen of cars and linked to the user’s prepaid account, allowing the toll fee to be taken from this associated bank account. They are made mandatory at all NHAI toll booths across India. do the same

4. Question: Can I use my FASTag in another car?

Answer: Can a FASTag bought for my one vehicle be used for another vehicle? No, as per guidelines FASTag is issued to each vehicle based on an RC copy of the vehicle.