The Trump administration is taking a serious look at integrating Bitcoin into national economic policy via building a reserve. David Sacks, the recently appointed AI and Crypto Czar, has made it clear that exploring the feasibility of a U.S. Bitcoin Reserve is a top priority.

The idea? Accumulate Bitcoin as a strategic asset, similar to gold, to hedge against currency volatility and global economic shifts.

While details are scarce, the initiative signals that the U.S. may be preparing for a future where digital assets play a much larger role in monetary policy. Countries like El Salvador have already made Bitcoin legal tender, and some U.S. policymakers see an opportunity to establish America as a leader in the space.

Regulating Stablecoins: The GENIUS Act

Meanwhile, Congress is taking steps to bring regulatory clarity to stablecoins. Senator Bill Hagerty has introduced the GENIUS Act, a bill designed to set clear rules for stablecoin issuance and operation in the U.S. This move aims to provide a legal framework for companies offering digital dollar alternatives.

Stablecoins like USDT (Tether) and USDC (USD Coin) have seen explosive growth in recent years, but they exist in a gray area of financial regulation. The GENIUS Act seeks to change that by:

- Defining what constitutes a stablecoin and its legal classification.

- Ensuring that stablecoin issuers maintain full reserves for redemption.

- Establishing regulatory oversight to prevent fraud and systemic risks.

- Encouraging innovation while maintaining financial stability.

Why This Matters

The U.S. has been slow to adopt clear crypto regulations, creating uncertainty for businesses and investors. However, these recent moves suggest a shift in strategy. By considering a Bitcoin Reserve and creating stablecoin legislation, the government is acknowledging the growing importance of digital assets.

If the Bitcoin Reserve plan moves forward, it could reshape global perceptions of Bitcoin, elevating it to an even more legitimate asset class. At the same time, regulating stablecoins could help integrate them into mainstream finance, making them a more reliable and widely accepted means of digital payment.

Challenges & Roadblocks

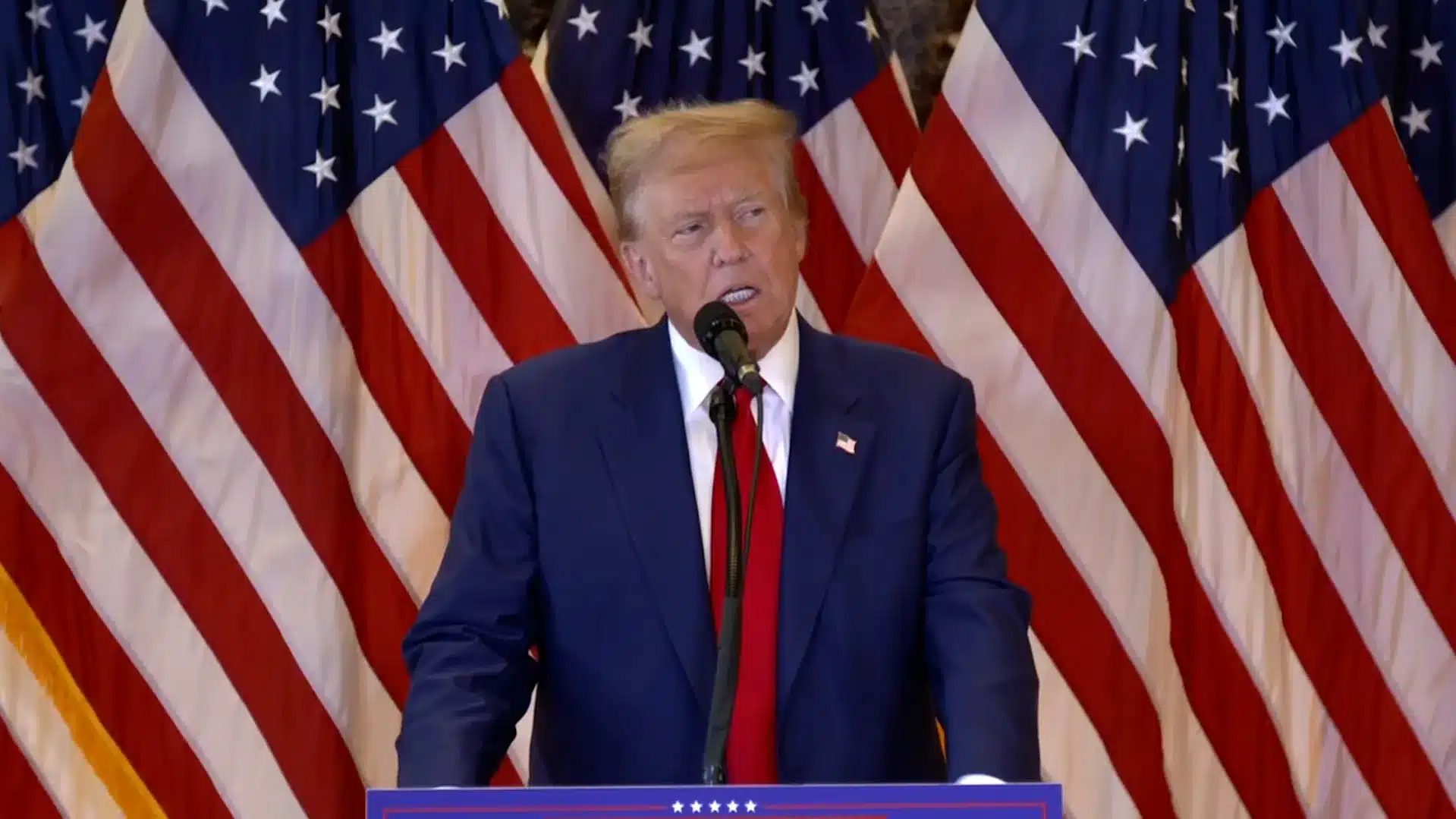

JUST IN:

President Trump’s Crypto Czar David Sacks says they are evaluating a Bitcoin Reserve. pic.twitter.com/rDvgIs7dly

— Watcher.Guru (@WatcherGuru) February 4, 2025

Of course, not everyone is on board with these ideas. Critics argue that accumulating Bitcoin as a reserve asset could expose the government to extreme price volatility. Others believe that stablecoin regulation, while necessary, could stifle innovation if not handled correctly.

Additionally, the Federal Reserve has been exploring the idea of a Central Bank Digital Currency (CBDC), which could compete with privately issued stablecoins. How these competing interests play out remains to be seen.

Source:https://themusicessentials.com/lifestyle-tips-and-trends/trumps-bold-crypto-move-bitcoin-reserve-and-stablecoin-regulation-in-the-works/