In this January 2025 Mahindra car sales analysis, we’ll look at the car sales of Mahindra for the previous month. We’ll also compare the YoY and MoM change to find out which Mahindra cars’ sales improved and which ones declined. To support the trends, we’ll also provide our opinions where applicable. Lastly, the table with monthly sales for the last 6 months will give you an idea about the 6-month sales trend of all Mahindra cars.

Gunning For The 2nd Spot

While their usual sales heroes like the Scorpio and XUV700 have been performing well for several years now, the 3XO along with some help from Thar Roxx, Mahindra are shaking up the auto industry.

And this behaviour isn’t going to change. With the BE6 and XEV 9e, they have conveyed that they’re not just here to sell electric cars. They’re here to set new benchmarks in terms of value and features. The pricing of these 2 EVs has shaken up not just carmakers like Hyundai, Tata and Maruti but also the Chinese/Chinese-owned carmakers like MG and BYD are feeling the sting. So much so that MG jacked up the prices of the ZS while leaving the base price unchanged. On top of that, they are willing to give away discounts of up to ~Rs. 2.50 lakh on the base trim, which is the highest we have ever seen. So, the price hike was just a smoke screen when in reality, they are feeling the pinch from Mahindra’s BE6 and the Tata Curvv EV.

We were counting on having a price war in the EV space in the 2025 – 28 period but a non-Chinese carmaker would take the first swing — that, we didn’t expect. The first swing will come from an Indian carmaker, that didn’t just come as a surprise, it came as a shock. It’s not this move that should scare the Chinese and even other carmakers. It’s their attitude and hunger for greater market share, which should scare their rivals.

The EV strategy suggests that this time around, they aren’t just going for one more bite out of the pie. They want the whole pie to themselves. Of course, it’s not going to be easy but it looks like they are gunning for it anyway. That should make Hyundai very worried as they have maintained their hold on the 2nd spot in the Indian car market for God knows how long.

Compared to Jan 2024, Mahindra and Maruti have gained market share while Hyundai and Tata have lost. Mahindra’s YoY gains of 17.63% come across as enormous compared to Maruti’s. However, the YoY decline of 10.37% in Tata’s sales suggests that they have graduated from 4th spot to 3rd. Since Hyundai also appear to have suffered some YoY decline in Jan 2025, it’s not too far-fetched to imagine that once Mahindra are feeling secure in the 3rd spot, they will be preparing to displace Hyundai from the 2nd spot.

In average sales, though, Hyundai remain firmly in the 2nd spot while Tata in 3rd spot. Mahindra are in the 4th spot with an average shortage of 1459 every month. We expect them to easily make up this gap and create a larger gap for Tata to crawl in this calendar year.

For 2025, Tata are also lining up the Sierra petrol/diesel and Sierra EV along with the Harrier EV. Mahindra are likely to bring a 3-row electric car (similar to XUV700 EV), the Scorpio N pickup and XUV 3XO EV.

What are your thoughts on the matter? Please let us know in the comments.

Jan 2025 — Mahindra Car Sales Figures – YoY Change

Jan 2025 — Mahindra Car Sales Figures – MoM Change

The table presents the month-over-month (MoM) sales data of Mahindra models for January 2025 compared to December 2024, including the change in units sold, percentage change, and trends.

Performance-Based Insights

Mahindra witnessed strong growth in Jan 2025 — 17.5% MoM and 22% YoY growth.

Top Performers (Jan 2025 Sales)

-

Scorpio-N and Scorpio Classic (15,442)

-

Bolero + Bolero Neo (8,682)

-

XUV 3XO (8,454)

-

XUV700 (8,339)

Top Gainers (YoY % Change)

Here are the top 3 YoY gainers of Jan 2025 in the Mahindra portfolio:

-

XUV 3XO (+75.50%)

-

Thar + Roxx (+24.72%)

-

XUV700 (+15.72%)

Top Losers (YoY % Change)

Despite a strong demand for MPVs, the Marazzo is having a tough time finding buyers. And it is a competent product too. Still, the judicial and executive wing of our government have done an excellent job of brainwashing consumers and demonizing diesel engines, which is hurting it real bad. The other things not working in the Marazzo’s favour are its distinctly-MPV-ish design and the lack of an automatic transmission.

-

Marazzo (-100%)

-

XUV400 (-58.68%)

-

Bolero (-12.87%)

Top Gainers (MoM % Change)

-

Bolero (+46.63%)

-

Scorpio (+26.63%)

-

XUV 3XO (+20.77%)

Top Losers (MoM % Change)

-

Marazzo (-100%)

-

XUV400 (-77.78%)

-

Thar (-1.33%)

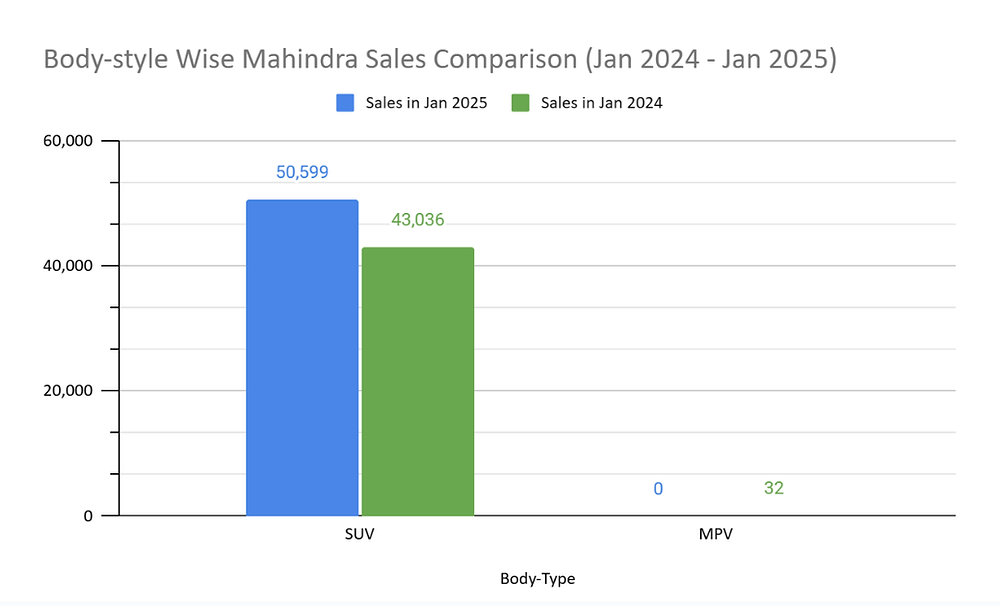

Body-Type Based

The following chart shows the YoY comparison of Mahindra’s production for various body styles:

Mahindra — 6-Month Sales Trend (Aug 2024 – Jan 2025)

Disclaimer: This post was written by our guest author (V3Cars). Any views expressed in this article are those of the author and do not necessarily represent those of Autopunditz.com. The data presented in this article is the property of Autopunditz.com.