Income tax Budget 2025 LIVE: In her budget statement, Finance Minister Nirmala Sitharaman declared that under the new tax system, those earning up to ₹12 lakh would not be obliged to pay taxes. For incomes up to ₹12 lakh ( ₹12.75 lakh for salaried taxpayers with a basic deduction of ₹75,000), the new tax regime gives 0% income tax.

The government has established new tax slabs to significantly lower middle-class taxes and give them more money, which will increase household consumption, savings, and investment.

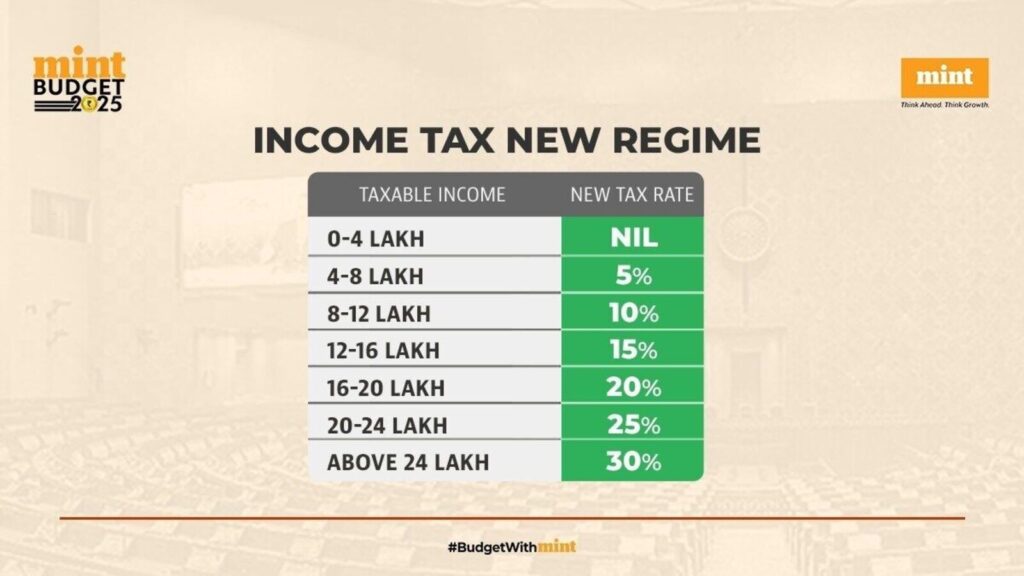

Income tax slab changes budget 2025: The tax slabs and rates are as follows

0-4 lakh rupees: Nil

4-8 lakh rupees: 5%

8-12 lakh rupees: 10%

12-16 lakh rupees: 15%

16-20 lakh rupees: 20%

20-24 lakh rupees: 25%

Above 24 lakh rupees: 30%

Under the new tax regime, individuals earning up to ₹12 lakh annually will not have to pay any income tax. As per the rejig, for people earning more than ₹12 lakh per annum, there will be nil tax for income up to ₹4 lakh, 5 per cent for income between ₹4 and 8 lahks, 10 per cent for ₹8-12 lakh, and 15 per cent for ₹12-16 lakh.

A 20 per cent income tax will be levied on income between ₹16 and 20 lakh, 25 per cent on ₹20-24 lakh and 30 per cent above ₹24 lakh per annum.

Income Tax Budget 2025 LIVE: Defence Minister Rajnath Singh congratulates Finance Minister Nirmala

Defence Minister Rajnath Singh on Saturday congratulated Finance Minister Nirmala Sitharaman for presenting a “wonderful” Budget towards fulfilling the resolve of Prime Minister Narendra Modi.

“I congratulate the Finance Minister, @nsitharaman, who has presented a wonderful Budget towards fulfilling the resolve of Prime Minister Mr. @narendramodi ji to develop India. This Budget will promote the development of youth, poor farmers, and women, as well as all sections and regions of the society,” Singh said in a post on X.

Income Tax Budget 2025 LIVE: Ajay Singh, Chairman and Managing Director, SpiceJet on the budget announcements

“This is a forward-looking, middle class-friendly budget that promises to boost spending, stimulate development, and set the stage for India’s growth in the coming years.

With the launch of a modified UDAN scheme that will introduce 120 new destinations and bring 4 crore additional passengers into the fold over the next decade, the aviation landscape in India is set for a transformative shift. This initiative will not only make air travel more accessible to remote regions but will also drive economic growth and tourism, further empowering local economies.

UDAN has proven to be one of the most successful schemes under the Modi government, and as the first private airline to participate, SpiceJet remains fully committed to actively supporting its continued growth.”

Income Tax Budget 2025 LIVE: Is it advisable to choose the new tax regime post-budget announcements?

In the Union Budget 2025-26, Finance Minister Nirmala Sitharaman announced significant changes to the income tax structure, particularly under the new tax regime. The tax-free income threshold has been raised to ₹1.2 million, and the tax slabs have been adjusted to benefit low- and middle-income taxpayers.

These reforms aim to increase disposable income, thereby boosting consumption and stimulating economic growth. However, the new tax regime continues to exclude most deductions and exemptions.

“The choice between the old and new tax regimes is not one-size-fits-all. It depends on your income structure, investments, and financial goals. Evaluate both before making a decision.

Given the recent changes, it’s advisable to reassess your financial situation to determine which tax regime aligns best with your objectivesm,” said Abhishek Soni, CEO and Co-founder Tax2win.

Income Tax Budget 2025 LIVE: Zero income tax up to ₹12 lakh is ‘historic relief’ for middle-class, says TDP

Zero income tax up to an income of ₹12 lakh per annum as announced in the union budget on Saturday is a ‘historic relief’ for the middle class, TDP said. “Historic relief for the middle class. Zero income tax up to ₹12 lakh – more savings, more spending power,” Telugu Desam Party spokesperson Jyothsna Tirunagari said in a post on ‘X’.

Income Tax Budget 2025 LIVE: Banking Sector reaction on Union Budget

“The Union Budget reflects a strong commitment to empowering MSMEs, agriculture, and rural credit, which are the backbone of India’s vision for attaining Viksit Bharat. The enhanced focus on credit access for small businesses and farmers will catalyze growth and financial inclusion. Additionally, the increase in tax exemption to ₹12 lakh is a significant step in boosting disposable income and strengthening consumption. Indian Bank remains committed to supporting these initiatives, driving sustainable economic progress, and financial inclusion,” said Indian Bank’s MD & CEO, Shri Binod Kumar

Income Tax Budget 2025 LIVE: Expert take on Budget 2025

“The reduction of Jewellery duty from 25% to 20% is a welcome move. For a country like India who is known for its high jewellery consumption, this will definitely boost the demand in the domestic market specially in luxury. Similarly, slashing of duty on platinum finding from 25% to 5% is yet another bold move which will prove beneficial for the entire gems and jewellery industry,” said Colin Shah, MD, Kama Jewelry

Income Tax Budget 2025 LIVE: No income tax up to 12 lakh

“This opens up opportunities to explore a variety of wealth-building avenues, from traditional investments like mutual funds and stocks to digital assets like crypto. It encourages financial planning, empowering individuals to diversify their portfolios, and supports long-term wealth creation,” says Edul Patel, CEO and Co-founder of Mudrex.

Income Tax Budget 2025 LIVE: 100% FDI in Insurance

The decision to raise FDI in insurance to 100% will drive greater capital infusion into the sector. This move will not only deepen investments but also foster innovation, enhance competition, and accelerate insurance penetration. “We welcome this progressive reform, which aligns with our commitment to delivering greater financial security to Indians. With strengthened investment, the industry can further drive digital transformation, develop customer-centric solutions, and expand its reach to those who need it most,” said Prashant Tripathy, MD & CEO, Axis Max Life Insurance.

Income Tax Budget 2025 LIVE: Union Budget 2025 has introduced several tax reforms

Anirudh Garg, Partner and Fund Manager at Invasset PMS: The Union Budget 2025 has introduced several tax reforms and sector-specific initiatives that are likely to shape market sentiment and economic growth. The decision to forgo ₹1 lakh crore in direct taxes and offer full tax exemption up to ₹12 lakh income under the new regime is expected to boost consumer spending, benefiting sectors such as FMCG, automobiles, and retail. The middle class and salaried professionals will have more disposable income, driving demand in these areas.

Income Tax Budget 2025 LIVE: Amit Maheshwari of AKM Global Praises Transfer Pricing Scheme

Amit Maheshwari, Partner-Tax, AKM Global, a tax and consulting firm: “The Finance Minister has announced a scheme for transfer pricing to determine arm’s length prices for block of 3 assessment years if international transactions or specified domestic transactions are same in 2 consecutive years. This will reduce administrative burden on taxpayers as well as tax department as there will be no requirement of determining arm’s length price every year. This scheme may be an excellent option for big corporations with history of litigation every year. However, adoptability of the scheme may be challenging for small and medium size corporations as they may be sceptical for approaching tax authorities fearing an adverse stand.”

Income Tax Budget 2025 LIVE: ‘Highly beneficial for the middle class and senior citizens’

“Overall, this budget is highly beneficial for the middle class and senior citizens, with key measures aimed at increasing savings and boosting consumption. The increase in the TCS threshold limit from ₹7 lakh to ₹10 lakh and the doubling of the TDS threshold for senior citizens provide significant relief. Additionally, with no income tax payable up to ₹12 lakh, disposable income will rise, leading to higher spending and economic growth. These steps not only support the common man and industry but also align with the vision of a Viksit Bharat by 2047, making it a well-balanced and progressive budget,” said Meghna Mishra, Senior Partner at Karanjawala & Co.

Income Tax Budget 2025 LIVE: What Nirmala Sitharaman Said About Income Tax Cut

Personal Income- tax Reforms with special focus on middle class 156. Democracy, Demography and Demand are the key support pillars in our journey towards Viksit Bharat. The middle class provides strength for India’s growth. This Government under the leadership of Prime Minister Modi has always believed in the admirable energy and ability of the middle class in nation building. In recognition of their contribution, we have periodically reduced their tax burden. Right after 2014, the ‘Nil tax’ slab was raised to ₹2.5 lakh, which was further raised to ₹5 lakh in 2019 and to ₹7 lakh in 2023. This is reflective of our Government’sctrust on the middle-class tax payers. I am now happy to announce that there will be no income tax payable upto income of ₹12 lakh (i.e. average income of ₹1 lakh per month other than special rate income such as capital gains) under the new regime. This limit will be ₹12.75 lakh for salaried tax payers, due to standard deduction of ₹75,000. 157. Slabs and rates are being changed across the board to benefit all taxpayers. The new structure will substantially reduce the taxes of the middle class and leave more money in their hands, boosting household consumption, savings and investment. 158. In the new tax regime, I propose to revise tax rate structure as follows: 0-4 lakh rupees Nil 4-8 lakh rupees 5 per cent 8-12 lakh rupees 10 per cent 12-16 lakh rupees 15 per cent 16-20 lakh rupees 20 per cent 20- 24 lakh rupees 25 per cent Above 24 lakh rupees 30 per cent 28 159. To tax payers upto ₹12 lakh of normal income (other than special rate income such as capital gains) tax rebate is being provided in addition to the benefit due to slab rate reduction in such a manner that there is no tax payable by them. The total tax benefit of slab rate changes and rebate at different income levels can be illustrated with examples. A tax payer in the new regime with an income of ₹12 lakh will get a benefit of ₹80,000 in tax (which is 100% of tax payable as per existing rates). A person having income of ` 18 lakh will get a benefit of ` 70,000 in tax (30% of tax payable as per existing rates). A person with an income of ` 25 lakh gets a benefit of ` 1,10,000 (25% of his tax payable as per existing rates). 160. Details of my tax proposals are given in the Annexure. 161. As a result of these proposals, revenue of about ₹ 1 lakh crore in direct taxes and ₹ 2600 crore in indirect taxes will be forgone. Mr. Speaker Sir, with this, I commend the budget to this august House. Jai Hind

Income Tax Budget 2025 LIVE: On the changes in income tax slabs announced in Union Budget 2025

Sandeep Chilana, Managing Partner, CCLaw, says – “Raising the income tax exemption threshold to ₹12 lakh is a deeply positive move, especially for the middle class. For many, it brings a much-needed relief, considering the increasing living costs and pressures of inflation. By increasing disposable income, the government is not only simplifying the tax system but also fostering consumer confidence. This change will impact a broad spectrum of individuals, particularly in urban areas, giving them more room to invest and spend. The overall restructuring of tax slabs, aimed at a more equitable distribution, is also an encouraging step towards creating a progressive tax environment.”

Income Tax Budget 2025 LIVE: FM eases tax relief on two self-occupied properties, says Adhil Shetty, CEO of Bankbazaar.com

Adhil Shetty, CEO of Bankbazaar.com – “In a significant move, Finance Minister Nirmala Sitharaman relaxed the conditions for tax relief on self-occupied properties in the 2025 Union Budget. Taxpayers can now claim tax benefits for two self-occupied houses, a major change from the previous rule that allowed relief for only one property. This reform significantly eases the tax burden for individuals who own and live in multiple properties, offering financial flexibility and promoting homeownership. By acknowledging the diverse housing needs of families, this decision not only provides greater tax relief but also encourages real estate investment. The move aligns with the government’s broader focus on financial empowerment and ease of living, strengthening the middle class while simplifying the tax structure.”

Income Tax Budget 2025 LIVE: Experts take on Budget 2025

The Budget announcements are sending a clear message that Government will focus on governance, creating capacities, creating conditions conducive for compliance, execution and implementation of policies. The onus of demand creation has shifted to the private sector, middle class and the wider populace.

“Tax slabs have been rationalised in personal income tax, increasing the purchasing power of the consumers. Demand will get a boost specially in consumer discretionary items like FMCG, auto etc. Government has not been able to spend in capital expenditure of 11 lakh crores this year, probably because of lack of credible projects and the increase in the outlay for next year to only 11.21 lakh crs is slightly disappointing. The private sector is unlikely to undertake large capex due to uncertainty over tariff wars and fears of dumping form China.

It is a bold budget, as it takes a chance of putting the Indian consumer at centrestage. The demographic dividend in Indian democracy should create demand, which is a step in the right direction. Now it depends upon the resilience of the Indian middle class and the spirit of the private sector which will dictate the pace of Indian economic growth. Jay Ho!,” said Sandeep Bangla, CEO – TRUST Mutual Funds

Income Tax Budget 2025 LIVE: Income tax reforms in Budget 2025 among the biggest in the last decade, says Adhil Shetty,

Adhil Shetty, CEO, BankBazaar.com

The income tax reforms introduced in the budget are among the biggest in the last decade — simplified and rationalized to put more money in people’s hands without compromising the fiscal deficit.

The most important change has been the revision of the tax slabs keeping in line with inflation. This has been a long-standing request of the tax payers for the last so many years. In the updated tax reforms, with slabs adjusted for inflation, the 30% tax rate is now applicable above ₹24 lakh, up from the initial ₹15 lakh. This change in the 30% slab marks a 60% adjustment.

Under the proposed 2025 tax regime, someone earning ₹25 lakh annually will pay ₹3.43 lakh in total tax, compared to ₹4.57 lakh under the 2024 regime. This translates to 5% more money in hand and a monthly saving of around ₹9,500 — a substantial relief for taxpayers.

This rationalisation of income tax has been long-awaited and will go a long way in reaffirming the confidence of the people in the economy. More cash in hand will also mean increased spending, which will drive higher consumption and, in turn, will fuel economic growth.

Income Tax Budget 2025 LIVE: Expert take on social welfare surcharge

“The twin announcements of removal of seven tariffs resulting into reduced eight slabs of duty and levy of only one cess or surcharge thereby exempting 82 tariff line items from social welfare surcharge, would both lead to simplification of import duty computation, thereby easing compliances” said Harpreet Singh, Partner, Indirect Tax, Deloitte. Providing time limit of two years for completion of provisional assessments was a long-standing demand of the industry. This would go a long way in providing tax certainty to importers. “

Income Tax Budget 2025 LIVE: ‘This move provides relief to the middle class’, says expert on income tax announcements

Income Tax 2025 LIVE: At the outset, a very welcoming Budget! The Finance Minister has demonstrated that the Government holds the pulse of the nation and has tried a bold yet balancing act by increasing the income tax threshold to 12 lakh. “This move provides relief to the middle class, boosts consumption by injecting liquidity thereby helping the GDP, reducing compliance and the feeling of unjust treatment of salaried taxpayers – all in a single step. By focusing on decriminalising various provisions and increasing the threshold on interest and rental income, not taxing the deemed rent on self-occupied properties up to two properties, it also helped the senior citizens who were forced to claim refunds resulting in interest cost to the Government and feeling of injustice amongst the taxpayers,” said Kumarmanglam Vijay, Partner, JSA Advocates & Solicitors

Income Tax Budget 2025 LIVE: How this will benefit taxpayers

Under the new regime, a taxpayer with an income of ₹12 lakh will receive a tax benefit of ₹80,000.

A person having income of ₹18 lakh will get a benefit of ₹70,000 in tax.

A person with an income of ₹25 lakh gets a benefit of ₹1.10 lakh.

Income Tax Budget 2025 Live Updates: Big bonanza for middle class

Individuals earning up to ₹12 lakh annually will not have to pay any income tax under the new tax regime as Finance Minister Nirmala Sitharaman on Saturday gave relief to middle class by raising exemption limit and rejigging slabs.

For salaried employees, this nil tax limit will be ₹12.75 lakh per annum, after taking into account a standard deduction of ₹75,000.

“I am now happy to announce that there will be no income tax payable up to income of ₹12 lakh (i.e. average income of ₹1 lakh per month other than special rate income such as capital gains) under the new regime,” the finance minister said.

“The new structure will substantially reduce the taxes of the middle class and leave more money in their hands, boosting household consumption, savings and investment,” Sitharaman said in her Budget speech.

Income Tax Budget 2025 Live Updates: Experts take on women centric announcement

Gunjan Goel, Director, Goel Ganga Developments

The launch of the ₹5 lakh scheme exclusively to women, SC and ST is an impactful measure towards economic inclusiveness. This together with enhanced MSME credit limits offers women entrepreneurs a powerful combination. These initiatives will assist in closing the gender gap in business ownership and economic participation.

Mamta Shekhawat – Founder, Gradding.com

The scaling up of Saksham Anganwadi and Poshan 2.0 to include 8 crore children, 1 crore pregnant mothers and 20 lakh adolescent girls portrays an integrated concern for women’s and children’s health. Such comprehensive nutritional support, especially targeting lactating mothers and adolescent girls, will positively shift community health outcomes for many decades.

Ridhima Kansal, Director, Rosemoore

Women benefit from both economic empowerment with the ₹5 lakh scheme and nutritional security with Poshan 2.0 in a two pronged approach budgetary intervention. This married approach addresses the health and health infrastructure gaps with the financial gap that need to be closed for women’s advancement.

Income Tax Budget 2025 LIVE: Tax slabs and rates

The tax slabs and rates are as follows

0-4 lakh rupees: Nil

4-8 lakh rupees: 5%

8-12 lakh rupees: 10%

12-16 lakh rupees: 15%

16-20 lakh rupees: 20%

20-24 lakh rupees: 25%

Above 24 lakh rupees: 30%

As per the rejig, for people earning more than ₹12 lakh per annum, there will be nil tax for income up to ₹4 lakh, 5 per cent for income between ₹4 and 8 lakh, 10 per cent for ₹8-12 lakh, 15 per cent for ₹12-16 lakh.

A 20 per cent income tax will be levied on income between ₹16 and 20 lakh, 25 per cent on ₹20-24 lakh and 30 per cent above ₹24 lakh per annum.

View Full Image

Income Tax Budget 2025 LIVE: Tax Reforms Simplify Compliance, Benefit Middle Class

Income Tax Budget 2025 LIVE: Kuljeet Singh, Director of Finance and Accounts at GI Group Holding.

“Budget 2025 brings much-needed tax reforms aimed at simplification, compliance ease, and middle-class relief. The extension of the updated tax return filing window to four years offers greater flexibility to taxpayers to rectify or revise their filings. Rationalizing TDS and TCS, along with increased thresholds on rent and LRS remittances for individuals, will ease compliance. The removal of TCS on education loans up to ₹10 lakh is a positive step for families investing in higher education. These measures indicate a clear intent to simplify the tax regime and enhance financial flexibility for the tax payers, but their real impact will depend on effective implementation and taxpayer adaptation.”

Deduction u/s 80CCD for contributions made to the NPS Vatsalya

Income Tax Budget 2025 LIVE: Deduction u/s 80CCD for contributions made to the NPS Vatsalya

– It is proposed to extend the tax benefits available to the National Pension Scheme (NPS) under sub-section (1B) of section 80CCD of the Income-tax Act, 1961 to the contributions made to the NPS Vatsalya accounts, as applicable.

Income Tax Budget 2025 LIVE: Govt to raise insurance FDI to 100 pc

In another major reform move, the minister announced that the Foreign Direct Investment (FDI) in the insurance sector will be increased to 100 per cent from 74 per cent.

Presenting the Budget for 2025-26, Sitharaman said that over the past 10 years, the government has implemented several reforms for the convenience of taxpayers, including faceless assessment.

Sitharaman also mentioned the government coming out with taxpayers’ charter, faster returns process and almost 99 per cent of the income returns being on self-assessment.

Income Tax Budget 2025 LIVE: Govt to introduce new I-T bill in Parl next week

The government will introduce a new Income Tax bill next week to take forward the “trust first, scrutinise later” concept, Finance Minister Nirmala Sitharaman said on Saturday.

The bill is expected to simplify the current Income Tax (I-T) law and make it easier to comprehend.

Income Tax Slabs Budget 2025 LIVE

Income Tax Slabs Budget 2025 LIVE: A 20 pc income tax will be levied on income between ₹16-20 lakh, 25 pc on ₹20-24 lakh and 30 pc above ₹24 lakh.

Income Tax Budget 2025 LIVE :On the introduction of the new Income Tax Bill

On introducing the new Income Tax Bill, Sandeep Chilana, Managing Partner, CCLaw, says – “A complete overhaul of the Income Tax Act is a bold step, but the real question is whether it will truly simplify compliance or just reorganize complexities. If the new law can bring predictability, reduce disputes, and ease tax administration, it will be a game-changer. However, businesses and professionals will be watching closely to see how it handles legacy issues like retrospective taxation, complex exemptions, and litigation-heavy provisions. The success of this reform will depend on how effectively it balances revenue needs with a taxpayer-friendly approach.”

Income tax Budget 2025 LIVE: Zero Income Tax till ₹12 Lakh Income under New Tax Regime

-Slabs and rates being changed across the board to benefit all tax-payers

-New structure to substantially reduce taxes of middle class and leave more money in their hands, boosting household consumption, savings and investment

-‘Nil tax’ slab up to ₹12.00 lakh ( ₹12.75 lakh for salaried tax payers with standard deduction of ₹75,000)

View Full Image

Income tax Budget 2025 LIVE: Modified income tax time limit raised from two years to four years

Modified income tax time limit raised from two years to four years

Income tax Budget 2025 LIVE: Reducing burden on tax compliance

Income tax Budget 2025 LIVE: Compliance burden for small charitable trusts & institutions to be reduced, by increasing their registration period from 5 years to 10 years

Taxpayers to be allowed to claim annual value of two self-occupied properties as nil without any condition.

Income tax Budget 2025 LIVE: Rationalising TDS / TCS

– Limit for tax deduction on interest for senior citizens to be doubled from ₹50,000 to ₹1 lakh

– Annual limit for TDS on rent to be increased from ₹2.40 lakh to ₹6 lakh

-Threshold to collect tax at source on remittances under RBI’s Liberalized Remittance Scheme to be raised from ₹7 lakh to ₹10 lakh

Income Tax Budget 2025 LIVE: Social welfare surcharge exempted on 82 tariff lines subject to cess, says FM

7 Tariff Rates to be removed, over and above 7 rates removed in 2023-24 Budget Social Welfare Surcharge to be exempted on 82 tariff lines that are subject to a cess

Income Tax Budget 2025 LIVE: FM Sitharaman announces Gyaan Bharat Mission

FM Nirmala Sitharaman says that the government will set up the Gyaan Bharat Mission for survey, documentation and conservation of manuscript heritage.

Income Tax Budget 2025 LIVE: New Income Tax Bill next week, says FM Sitharaman

Finance Minister Nirmala Sitharaman announced the new Income Tax during the Budget speech.

Income Tax Budget 2025 LIVE: ‘National Manufacturing Mission’ will be set up

FM says for toys sector, will implement a scheme to make India a global manufacturing hub. ‘National Manufacturing Mission’ will be set up to further ‘Make In India’

Income Tax Budget 2025 LIVE: Infrastructure Ministries to present 3-Year PPP project pipeline

Infrastructure ministries will come up with 3-year pipeline of projects to be implemented in PPP mode: FM Sitharaman.

Income Tax Budget 2025 LIVE: Day care centre for cancer

FM Nirmala Sitharaman said that they will setup daycare centre for cancer in all districts within 3 years, says Finance Minister

Income Tax Budget 2025 LIVE: Kisan Credit Card loan limit will increase to ₹5 lakh

Income Tax Budget 2025 LIVE: Presenting the Union Budget 2025, Finance Minister Nirmala Sitharaman said the Kisan Credit Card loan limit will be increased to ₹5 lakh from the current limit of ₹3 lakh.

Income Tax Budget 2025 LIVE: Finance Minister Nirmala Sitharaman presents 4 engines of development

Finance Minister Nirmala Sitharaman lists four engines of development for the Union Budget 2025-25: Agriculture, MSMEs, investments, and exports.

Income Tax Budget 2025 LIVE: Sitharaman Budget announcements

-Govt to launch on 6-year program for Atamnirbharta in pulses with special focus on tur, urad, and masoor

-With quality products, MSMEs are responsible for 45 pc of our exports

-FM Sitharaman announces 5-year mission to promote cotton production.

-Makhana Board will be established in Bihar to improve production and processing of fox nut

Income Tax Budget 2025 LIVE: Budget aims to introduce transformative reforms for Viksit Bharat

Income Tax Budget 2025 LIVE: “We envision 100% quality, good school education, access to high-quality, affordable, and comprehensive health care, 100% skilled labor with meaningful employment, 70% women in economic activities, and empowering farmers, making our country the food basket of the world,” said FM.

Income Tax Budget 2025 LIVE: FM Nirmala Sitharaman highlights geopolitical challenges

Income Tax Budget 2025 LIVE: FM Nirmala Sitharaman says that Geopolitical headwinds suggest lower global economic growth.

-The focus is on inclusive development and boosting middle-class spending.

-This budget aims to accelerate growth and unlock the nation’s potential.

Income Tax Budget 2025 LIVE: ‘Our economy is the fastest growing among all major economies’, says FM

Union Finance Minister Nirmala Sitharaman says, “Our economy is the fastest growing among all major economies. Our development track record for the past 10 years and structural reforms have drawn global attention. Confidence in India’s capability and potential has only grown in this period. We see the next 5 years as a unique opportunity to realise sabka vikas, stimulating balanced growth of all regions.”

Income Tax Budget 2025 LIVE: FM Siatharaman presents her 8th budget

Income Tax Budget 2025 LIVE: FM Siatharaman is presenting her 8th budget

Income tax Budget 2025 LIVE: FM to begin her speech

Income tax Budget 2025 LIVE: Union Finance Minister Nirmala Sitharaman to begin her eighth consecutive Union Budget 2025 presentation in the Lok Sabha shortly.

Income Tax Budget 2025 LIVE: Union Cabinet approves the Union Budget 2025-26

Income Tax Budget 2025 LIVE: The Union Cabinet, chaired by Prime Minister Narendra Modi on Saturday ascended the Budget for the year 2025 ahead of its presentation in the Parliament.

Earlier Union Minister Amit Shah, Rajnath Singh, Gajendra Singh Shekhawat and Pralhad Joshi arrived at the Parliament.

Income Tax Budget 2025 LIVE: Crypto sector expectations from FM Sitharaman

Income Tax Budget 2025 LIVE: India has consistently ranked among the top nations in crypto adoption, showing the growing interest of Indians in the digital asset space. While the 2022 Union Budget clarified the ecosystem, it also brought challenges, especially with higher taxation. The 1% TDS on crypto transactions led many investors and traders to turn towards foreign exchanges, making it harder for the government to track activity. Additionally, the inability to offset losses against gains has further discouraged investor participation.

“We look forward to progressive approach that would encourage innovation and support sustainable growth for the sector. A reduction of TDS down to 0.01% and the allowance for offsetting losses could significantly benefit investors and drive positive momentum in the industry,” said Edul Patel, Co-founder & CEO of Mudrex .

Income Tax Budget 2025 LIVE: Cabinet meeting begins

Income Tax Budget 2025 Live: Ahead of the presentation of Budget 2025, the Union Cabinet meeting begins in Parliament.

Income Tax Budget 2025 Live: IncomeTax trends on X ahead of FM budget announcements

Income Tax Budget 2025 Live: Ahead of Finance Minister Nirmala Sithraman’s budget speech, #IncomeTax is trending on X. Sithraman will start her budget speech at 11 AM.

Source:https://www.livemint.com/money/personal-finance/income-tax-budget-2025-slab-live-updates-nirmala-sitharaman-announcements-new-old-tax-regime-taxpayers-1-february-2025-11738318133744.html