It wasn’t supposed to happen this quickly.

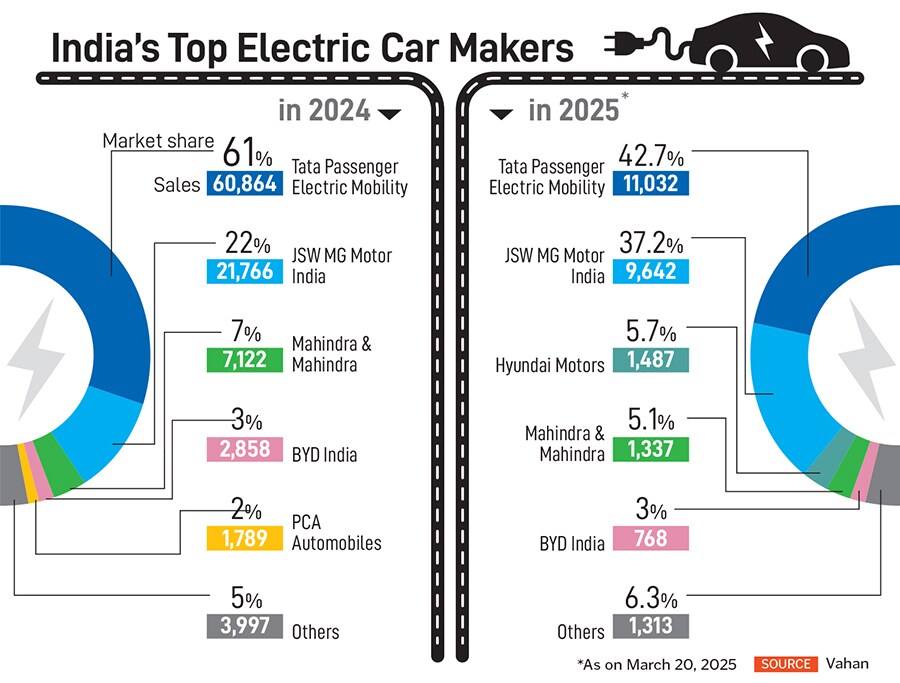

But then, India’s electric vehicle (EV) ecosystem itself has been undergoing a churn, with first-mover advantages slowly slipping away. Just two years ago, for instance, Tata Motors looked invincible, cornering nearly 80 percent of the market. The company was growing steadily, with investments into backend infrastructure, newer models, and charging networks, even as its competitors were languishing. The nearest competitor was MG Motor India, with a market share of just about 10 percent.

Two years later, Tata’s dominance has been whittled away significantly, with its market share dropping to 42 percent in the first three months of 2025, while sales of EVs have remained flat. MG Motor India, which in the meantime changed ownership and is now controlled by the Sajjan Jindal-led JSW Group, is busy taking the fight to Tata Motors, with its market share growing to 37 percent in the first three months of 2025. The likes of Hyundai, Mahindra, and BYD complete the remaining top five, having introduced newer models that are beginning to reshape the four-wheeler passenger EV market.

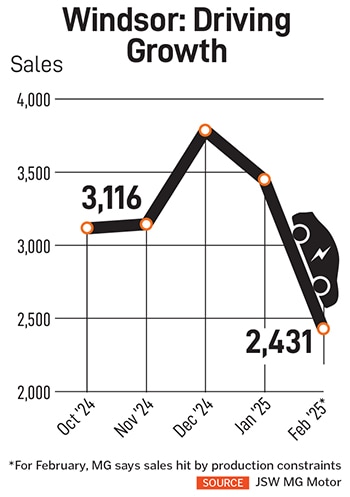

But even as the others revamp their EV portfolio, it is the resurgence of JSW MG Motor that’s likely to create some tough times for Tata Motors. Over the past months, JSW MG Motor’s Windsor, the Indian variant of the Chinese Baojun Yunduo, has consistently topped the charts to emerge as the largest-selling EV in the country. The Windsor often sells more than 3,000 units a month, and accounts for half of the automaker’s sales a month. About 70 percent of JSW MG Motor’s sales come from electric powertrains, comprising three models—ZS, Windsor and Comet.

“The Windsor is an optimum package that has hit a sweet spot in terms of what consumers expect from a car,” says Rajeev Chaba, chairman emeritus of JSW MG Motor India. “I think that’s a tipping point for EV sales in the country, since we are able to sell more than 3,000 Windsors a month.” The company launched the vehicle in October last year, and within a day received more than 15,000 bookings.

MG began retailing the car at less than ₹10 lakh, with a first-of-its-kind battery-as-a-service (BaaS) package, which allows customers to lease the battery for their EV instead of purchasing it, and paying a per-kilometre fee for usage.

“The MG Windsor EV has struck the right chord with Indian consumers, primarily due to its unique combination of features, price point, and MG’s ability to address significant barriers to EV adoption,” says Harshvardhan Sharma, head of auto retail practice at Nomura Research Institute. “Firstly, MG has leveraged the Battery-as-a-Service [BaaS] model, which lowers the upfront cost of ownership, making the EV more accessible. Secondly, the Windsor is positioned as a compact yet feature-packed vehicle that appeals to both urban and semi-urban consumers. By offering a substantial range, a robust infotainment system, and a modern design, MG has been able to capture the attention of consumers who want the benefits of an EV but at a competitive price point.”

MG’s strategy

Since it came to Indian shores in 2018, MG Motors has had a rather tumultuous time.

The company was set up by China’s largest automaker, SAIC Motor Corporation, which acquired General Motors’ Halol plant for more than ₹2,200 crore in 2017 and expanded its capacity. Its first launch was the SUV Hector, which struck a chord and got bookings of over 21,000 units within 20 days, even as production was limited to 2,000 units a month.

Since then, through its products including Astor, Gloster, ZS Comet, and Windsor, MG has managed to cement itself in the domestic automobile market, where the likes of Ford and General Motors have failed, thanks to a product-market fit approach. The company also launched the ZS EV, a pure EV with a 340-km range, in January 2020, before Covid-19 disrupted the country’s automobile landscape. The ZS EV, Chaba says, had received over 5,000 bookings and had the potential to catapult the automaker into the top rung of the EV market before the pandemic disrupted supply chains.

Alongside, growing scrutiny by the Indian government of Chinese automakers—border clashes between the neighbouring countries in 2020 dented diplomatic relationships—meant that expansion plans were severely hit, and in November 2022, the government began a probe into financial irregularities at MG Motor. By 2023, MG Motor said that it was looking to sell stake to fund expansion plans, and joined hands with the JSW Group, which bought a 35 percent stake in the company in March 2024.

The joint venture (JV) would soon prioritise local sourcing, improving charging infrastructure, expansion of production capacity, and introducing a broader range of vehicles with a focus on green mobility. The company was also renamed JSW MG Motor India.

The joint venture (JV) would soon prioritise local sourcing, improving charging infrastructure, expansion of production capacity, and introducing a broader range of vehicles with a focus on green mobility. The company was also renamed JSW MG Motor India.

With the Jindals on board, MG went ahead with the launch of the Windsor in October 2024, work on which had started almost 18 months before. “They [Sajjan and Parth Jindal] ratified the whole thing, but it was already in the pipeline,” Chaba says. Parth Jindal, Sajjan’s son, is a director at JSW MG Motor. “From their perspective, they were very clear that we need to accelerate the green-ification of our portfolio at the earliest. We also needed to localise a lot,” Chaba adds.

It had also helped that since its foray into India, Chaba says, MG had been heavily focussed on technology and innovation, alongside customer experience.

“They have certainly found a sweet spot with the Windsor,” says Vinay Piparsania, founder and principal of MillenStrat Advisory & Research and a former executive director at Ford India. “The utility vehicle category is popular in the market, and they could offer a product that appeals to the family, offer range, features, and fit in large cargo. If it wasn’t for the constrained production, their numbers would have been higher.”

Also read: Indian auto sector in 2025: Hoping for slow but steady growth

Winning with Windsor

What also seems to be a game-changer of sorts is the company’s focus on BaaS, a scheme that allows the customer to pay for using the battery on a rental basis. MG also onboarded financiers including Bajaj Finance Limited, Hero FinCorp, VidyutTech Services Private Limited, Ecofy and Autovert Technologies Private Limited to partner with the service. Customers can choose their package based on usage, with options for 3-year or 5-year plans. MG now offers BaaS in all its offerings.

“We call the Windsor an ABC car,” Chaba says. “We have priced it as an A-segment car.” In automotive parlance, an A-segment car would include the Maruti Brezza or the Hyundai i20, usually costing around ₹10 lakh. With the BaaS option, MG sells the car around that price, with the battery rental costs as an addition. Even then, the running costs work out cheaper than filling fuel per month, claims Chaba.

“The Windsor is a 4.3-m car, which is ideal, making it similar to a B-segment SUV,” adds Chaba; B-segment SUVs include the Hyundai Creta, Kia Seltos, and Volkswagen Tiguan. The category is one of the largest in India. “On the inside, the vehicle is like a C-segment vehicle, like the Hector. This is why we have a product that sits at the sweet spot.”

Sharma of Nomura adds that MG’s approach aligns with the changing preferences of Indian consumers, who are increasingly gravitating towards technology-driven, sustainable, and cost-effective alternatives. “With a price tag that’s competitive against internal combustion engine [ICE] vehicles and the Tata Nexon EV, the Windsor allows customers to transition to EVs without feeling financially burdened. Additionally, MG’s brand equity and after-sales service help solidify its position in the market.”

Also read: With MG, JSW wants to create a “Maruti moment for electric vehicles”

Taking on Tata

With a portfolio of three EVs, and two more to be launched this year, MG seems to have made all the right moves to zoom ahead in the domestic EV market. The company intends to sell the new models, a two-door cabriolet Cyberster roadster, and the MPV Mifa 9, through a new range of retail stores it calls MG Select.

“MG has been innovative with its overall Windsor offering, providing good value to customers,” says Puneet Gupta, director at S&P Global Mobility. “Car manufacturers need to rethink their EV sales techniques. MG’s subscription model has helped address concerns about reliability and trust in EVs. Although only 20 percent of buyers opt for the subscription model, it has served as an effective marketing tool to attract new customers.”

“MG has been innovative with its overall Windsor offering, providing good value to customers,” says Puneet Gupta, director at S&P Global Mobility. “Car manufacturers need to rethink their EV sales techniques. MG’s subscription model has helped address concerns about reliability and trust in EVs. Although only 20 percent of buyers opt for the subscription model, it has served as an effective marketing tool to attract new customers.”

This means Tata Motors now has a serious task at hand. Tata, which launched its first EV in October 2019, currently has a portfolio comprising Curvv, Nexon, Punch, Tigor, and Tiago. Despite that, in February alone, sales fell by 26 percent, while MG’s grew 198 percent.

“Tata needs to quickly adapt,” adds Gupta. “They need to reassess their value proposition, align with competitors, and take proactive steps to address customer needs.” Tata meanwhile has announced plans to deliver 10 new EVs by next year and has outlined plans to invest ₹18,000 crore for its EV business; it plans to launch EV variants of the Harrier, followed by the Sierra and Avinya this year.

By 2030, about 40 to 45 percent of two-wheelers and 15 to 20 percent of four-wheeler passenger vehicles sold in India will likely be electric, according to a report by Bain & Company, while the government wants EV penetration to hit 40 percent for buses, 30 percent for private cars, 70 percent for commercial vehicles, and 80 percent for two-wheelers.

Consequently, homegrown automakers have been scaling up electric offerings. India’s fourth largest automaker, Mahindra, for instance, recently received a staggering 30,000 bookings for two of its new launches. It has also laid out plans to increase its annual production capacity from 90,000 to 200,000 units by March 2026, with plans for EVs to constitute 20 percent of its SUV sales by 2027 and the introduction of five additional electric models by 2030.

Among others, Hyundai has launched an electric version of its category-leading SUV, Creta, while Maruti Suzuki is expected to launch an electric version of its popular SUV Vitara this April. For MG though, the focus remains not on the competition, but on itself and that’s what it intends to do over the near term now. “I am harsh on myself, but the foundation is good in terms of the brand image, customer satisfaction, and network,” Chaba says. “But we need to show profits, and we need to show growth. That’s the path ahead”

Source:https://www.forbesindia.com/article/take-one-big-story-of-the-day/how-jsw-mg-motor-eroded-tata-motors-ev-lead/95716/1