The Union government is planning new rules for ships and ports to meet the forthcoming International Maritime Organisation (IMO) emission regulations, according to two persons aware of the matter. This move will have a significant bearing on the country’s ambitious maritime development agenda.

The new regulations will have an impact on design, construction and operation costs of ships; along with structural design of existing and new mega ports and shipyards. It will also include new fuel standards for ships and a global pricing mechanism for emissions.

The rules will specify norms for putting up green fuel filling stations at ports including programmes for training of manpower in related activities, the two persons in the know said. The rules will also suggest design parameters for new ships being built at Indian shipyards so that they have dual fuel options for ships or design ships that are completely built to use green fuel such as compressed natural gas/liquefied natural gas, methanol, ammonia, green hydrogen and even electricity.

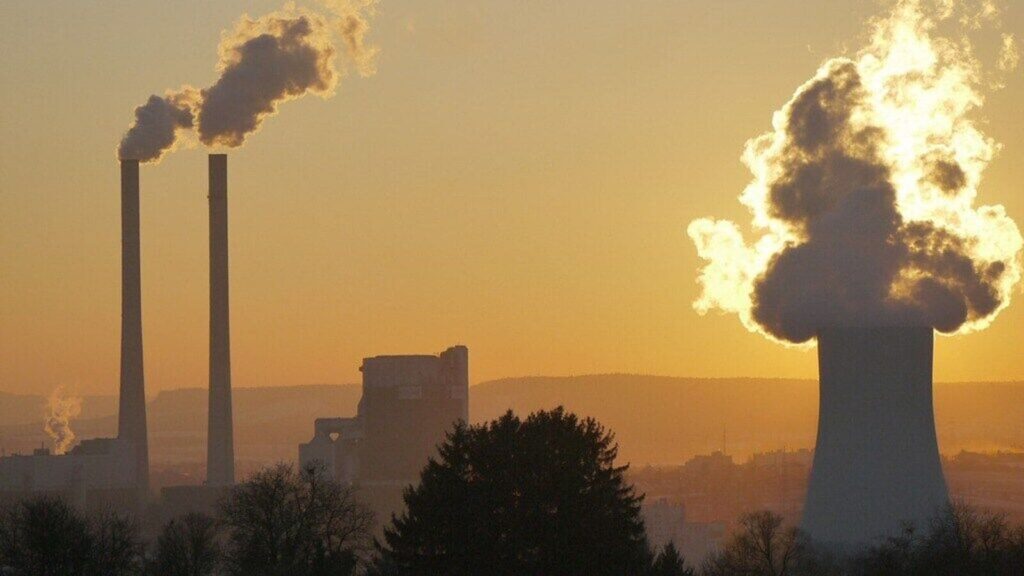

Currently, diesel is the primary fuel for vessels, ferries and tugboats plying on inland waterways, certain coastal routes and on international routes.

The rules will also have provisions for phased reduction in carbon dioxide (CO2) emission, and a time-bound plan for green upgrade of ports; with mandatory engagement of classification societies for earlier compliance assessment.

“The directorate general of shipping (DGS) under ministry of ports, shipping and waterways has already issued guidance note on IMO’s Net Zero Framework and Greenhouse Gas Fuel Intensity (GFI)-based compliance measures to enable stakeholders across across the Indian maritime ecosystem to understand, prepare for, and comply with the forthcoming regulatory requirements under the IMO’s Revised GHG Strategy 2023,” said the first person quoted above.

Orientation document

“The Guidance Note shall serve as an initial orientation document until formal rules and national-level implementation guidance including operational guidelines, compliance templates, and capacity-building frameworks are notified by the directorate in line with forthcoming IMO decisions,” he added.

The new IMO regulations for the shipping industry aims to achieve net-zero emissions from international shipping by or around 2050, subject to national circumstances through mid-term measures comprising a technical Global Fuel Standard (GFS) and a market-based GHG (green house gas) pricing mechanism.

The GFI-based mechanism, expected to formally come into force in March 2027 and effectively from 2028, mandates aprogressive reduction in the lifecycle carbon intensity of fuels used by ships above 5,000 GT engaged in international voyages. The mechanism is applicable to all ships flying the flag of a party to MARPOL (International Convention for the Prevention of Pollution from Ships). MARPOL is the primary international convention, developed by the IMO, aimed at preventing marine pollution from ships.

“The IMO regulations will have significant operational, economic, and strategic implications for shipowners, ports, training institutes, classification societies, and fuel suppliers. The new regulations will prepare the industry to comply with International obligations while also establishing national-level policies on green shipping,” said the second person quoted above.

According to the Directorate General of Shipping, the total compliance cost for India is projected at $87-100 million annually by 2030, assuming partial reliance on remedial units. This is equivalent to a 14% increase in fuel cost and 5% increase in freight rates—well within industry operating margins.

Green fuels

But, India may also benefit from IMO regulations, given its target of producing 5 million tonnes (MT) of green hydrogen by 2030. This enables production of 28 MT of ammonia and 26.3 MT of methanol, which qualify under the IMO’s GFI reward system. Green fuels with lower lifecycle emissions earn compliance credits and shipping rewards, boosting India’s export potential and investment in clean bunkering infrastructure.

Also Read: Non-stop renewable energy key to lowering green hydrogen prices: Gentari CEO

Query mailed to the ministry of ports , shipping and waterways (MoPSW) remained unanswered till press time.

The country is already taking big strides towards greening its maritime structure, which includes the development of green hydrogen hubs and the initiation of alternate fuel programmes at ports. “Kandla and Tuticorin ports are set to become the country’s first green hydrogen and green ammonia refuelling hubs for green shipping,” said Rajiv Jalota, former chairperson of Mumbai Port Authority and advisor at Indian Ports Authority. The government has also initiated a green tug programme under which harbour tugs powered by cleaner and more sustainable fuels would be used at all major ports. “Moreover, Harit Sagar, green port guidelines have been issued by the shipping ministry that targets reduction of carbon emissions at major ports through focused implementation and close monitoring of green initiatives. Ports are being encouraged to plan infrastructure for green bunkering and digital inspection protocols to streamline compliance verification. These should allow India to comply with any global regulations without having any adverse impact on the industry,” he added.

IMO funds

The main issue with the proposed IMO regulation on net zero emissions is the distribution of money collected by the organisation by levying penalties on ships that are non-compliant with emission standards, he said. “While discussions are still on how to distribute funds accumulated by IMO to countries such as India to help its industry get technology and fuel required to reduce emissions by the industry,” Jalota said.

To facilitate the Indian shipping sector in smoothly embracing the 2027 IMO regulations, there is a need for a concerted, multi-stakeholder approach, said Pushpank Kaushik, CEO & head of Business Development at Jassper Shipping, a Hyderabad-based global shipping and logistics firm. The government needs to offer transparent regulatory road maps complemented by green finance interventions, tax breaks, and retrofitting incentives. “Refurbishment of domestic shipyards is vital, and their inclusion in the Harmonized Master List of Infrastructure Sub-sectors is a welcome and opportune step,” Kaushik added.

As significant is building capacity, Indian seafarers and technical staff need to be equipped to deal with new propulsion technologies and alternative fuels. Use of digital fleet management systems to track emissions and optimize operational efficiency will also be critical. “India will also have to partner with global maritime organizations and utilize tools such as the IMO Net-Zero Fund to fund green infrastructure and training of the workforce,” he added. With sound policies, collaborations, and investments, regulatory compliance can be a dynamic driver of maritime innovation and world leadership, he said.

Also Read: Can India’s maritime ambitions turn the tide on China’s?

Meeting fuel norms

According to the DGS, all stakeholders—including Indian shipowners, managers, port authorities, fuel suppliers, classification societies, and training institutions have been advised to review the Guidance Note issued by it in detail and initiate necessary preparatory measures. This includes monitoring ship-level fuel intensity data; reviewing procurement strategies for low-GHG fuels; enhancing technical training on GFI methodologies; planning green infrastructure upgrades at ports and engaging with classification societies for early compliance assessment.

The immediate impact of IMO regulations would be limited on the Indian Maritime segment, given that out of India’s current fleet (Indian flagged) strength of 1,524 registered vessels; only 212 ships (14%) qualify as foreign-going and are of above 5,000 gross tonnage (GT). Also, of these, only 135 ships are regularly engaged in overseas trade and would be subject to IMO compliance. While the global shipbuilding market is dominated by China, South Korea and Japan; India currently has 28 shipyards.

But, Indian yards are already exploring retrofitting solutions and green ship designs. The regulation incentivizes demand for dual-fuel ships, alternative propulsion, and emission monitoring systems-creating new opportunities for domestic innovation and international competitiveness.

Also, exporters chartering foreign ships will indirectly bear additional freight costs if vessels are non-compliant. Indian exporters are encouraged to factor GHG compliance in chartering decisions to minimise long-term freight inflation risks, the first person said.

Source:https://www.livemint.com/industry/india-notify-new-rules-meet-imos-zero-emission-regulations-get-ports-and-shipping-green-compliant-11748608063013.html