New Delhi: The New Tax Regime, introduced couple of years ago by Finance Minister Nirmala Sitharaman, entitled salaried individuals for a lower rate of tax. The rider, however, was that the individuals did not take the benefit of certain deductions and exemptions.

New Tax Regime: HRA Deductions Not Available

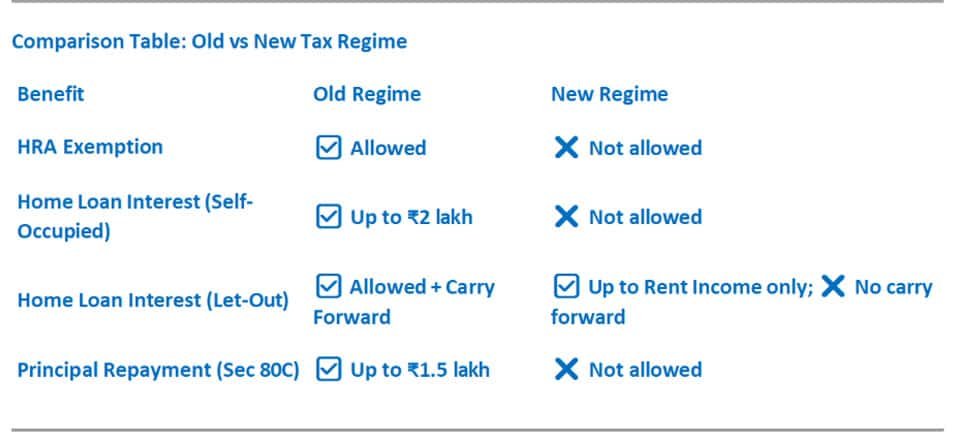

The new tax regime under Section 115BAC of the Income Tax Act offers lower tax rates in exchange for giving up most exemptions and deductions. Two significant components impacted by this shift are House Rent Allowance (HRA) and home loan benefits.

Under the new regime, HRA exemption under Section 10(13A) is not available. This means salaried individuals receiving HRA and paying rent cannot claim any tax benefit. In contrast, the old tax regime allows HRA exemption subject to conditions.

New Tax Regime: Interest Paid On Home Loan Not Available

For home loans, interest paid on a self-occupied house is not deductible under the new regime. However, if the property is let out, interest can be deducted only up to the rental income. Any excess interest loss cannot be carried forward to future years—a major restriction compared to the old regime.

The old regime, however, continues to allow:

· Deduction of interest on home loan under Section 24(b) (up to Rs 2 lakh for self-occupied properties),

· Principal repayment under Section 80C (up to Rs 1.5 lakh), and

· HRA exemption under Section 10(13A).

HRA Under Section 10(13A)

Under Section 10(13A) HRA, an employer may give its employees a House Rent Allowance (HRA) to help them pay their rent. Such a benefit is taxable in the employee’s hands. However, section 10(13A) of the Income Tax Act allows for the deduction of HRA within specific parameters.

Can you claim tax exemption on home loan under the new tax regime? What Role HRA plays in New tax regime? CA and Advocate Kinjal Bhuta, secretary, Bombay Chartered Accountants’ Society told Zee News, “Section 24(b) allows claim of interest on housing loan on self-occupied property upto Rs 2 lakhs. This interest is allowable under the old regime, however the same cannot be claimed under the new tax regime. There is no upper limit on interest on rented property, and the same can be claimed from the house property income under both the tax regimes.”

Sudhir Kaushik, Co- Founder & CEO, TaxSpanner (A subsidiary of Zaggle) further explained that any interest paid on the home loan for a self occupied property is not allowed to be claimed under New tax regime because the loan can only be claimed against the income generated in that particular head, i.e. House in the given case.

“Now since in case of self occupied house, no rental income is generated, hence, no claim of interest on loan is possible. However, if the house is rented out and a rental income is generated, then the interest on loan can be claimed limited to the income that is taxable under that head. Any excess & unclaimed amount of interest on home loan can be carried forward and is allowed to be set off only against the House property income. But there is no such restriction in Old tax regime,” Kaushik added.

HRA exemption is not allowed to be claimed under New tax regime. However, under old tax regime it can be claimed. Also there are situations when HRA can be claimed along with the interest on loan for purchase or construction of a house. Situations when HRA & loan both can be claimed under OTR;

a) Person is having a house in different city and is self occupied(family is living) or let out & is living on rent in the city where his office is located – Interest & principal, both can be claimed

b) Person is having a house which is under construction in same city & is living on rent in the city where his office is located – Principal amount can be claimed

c) Person is having a house in same city in which his office is located and is let out & is living on rent in the same city – either HRA or Interest can be claimed. No restriction in claiming the principal.

Kaushik adds, “Under the new tax regime, home loan interest on a self-occupied property cannot be claimed, as no income arises under ‘Income from House Property’. However, if the house is let out, interest deduction is allowed up to the rental income; excess can be carried forward. HRA exemption is not available under the new regime. In contrast, under the old regime, both HRA and home loan benefits (interest and principal) can be claimed in specific cases—such as residing in a rented house while owning another property in a different city or under construction.”

Source:https://zeenews.india.com/personal-finance/can-you-claim-tax-exemption-on-home-loan-under-the-new-tax-regime-what-role-hra-plays-in-new-tax-regime-explained-2919005.html