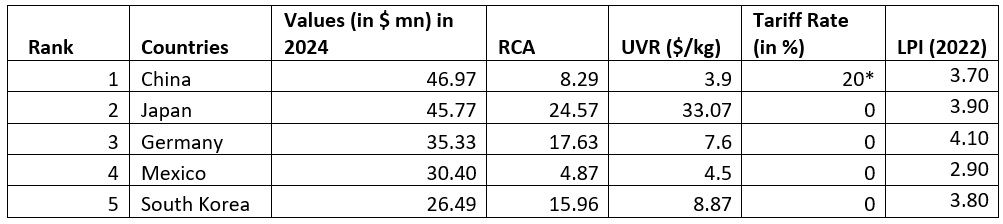

Table 1: Top exporting countries and market performance – HS-560394 – nonwovens (> 150 G/ M²) in CY 2024

US market for HS-560394 nonwovens (>150 G/M²) is intensely competitive, dominated by China in volume, with Japan leading in premium segments.

Tariff hikes significantly impact China’s price advantage, potentially benefitting Mexico temporarily.

However, looming tariffs on Mexico may redistribute market shares, providing opportunities for Japan, Germany, and South Korea to expand their presence.

Source: TradeMap and F2F Analysis

*Effective March 4

Note: LPI – Logistics Performance Index

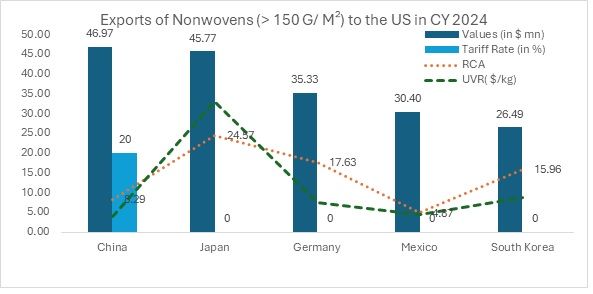

Graph 1: Key observations on HS-560394 – nonwovens over 150 G/M² and trade statistics for CY 2024

Source: TradeMap and F2F Analysis

Trade review

China

China dominates the export market for this product category, with a total export value of $46.97 million. Its RCA of 8.29 highlights a strong competitive position, indicating specialisation and efficiency in production. The UVR of $3.90/kg suggests a strategy centred on high-volume, cost-effective manufacturing, allowing it to maintain price competitiveness in US markets. Additionally, the 0 per cent tariff rate further enhances China’s export potential, facilitating smooth trade flows and reinforcing its leadership in this sector.

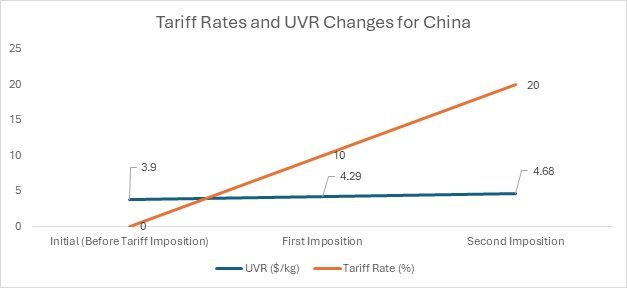

Tariff Impact: With the first tariff imposition on February 4, 2025, the tariff rate increased to 10 per cent. This rise in the tariff burden would lead to an increase in the UVR as production and export costs escalate. As a result, the UVR would likely increase to around $4.29/kg, reflecting the growing challenges posed by higher tariffs. The increase in the UVR shows that the products are becoming more expensive, which could make them less competitive for price-sensitive consumers.

Graph 2

Source: F2F Analysis

In the second tariff imposition, effective from March 4, 2025, the tariff rate rose further to 20 per cent. This substantial increase would push the UVR to approximately $4.68/kg or higher. The higher tariff will continue to raise costs, further diminishing the cost-effectiveness of the products. Mexico would become a close competitor to China after the tariff rate increase. However, this depends on the tariff impositions that will also be placed on Mexico by the Trump government after April 2, 2025, as announced.

Japan

Japan holds the second position in export value at $45.77 million, but it leads in RCA at 24.57, indicating a highly specialised and competitive position in nonwoven textiles. Its UVR of $33.07/kg is significantly higher than competitors, reflecting a strong emphasis on premium-quality, high-performance products. This suggests that Japan’s exports cater primarily to specialised industries such as healthcare, advanced filtration, and high-tech applications. The 0 per cent tariff rate further supports its global trade position, allowing seamless market access for its high-value nonwoven textiles.

Germany

Germany, renowned for its advanced textile technology, records an export value of $35.33 million with a strong RCA of 17.63, highlighting its competitive edge in high-quality nonwoven textiles. Its UVR of $7.60/kg is notably lower than Japan’s but higher than China’s, reflecting a balanced approach between quality and cost-efficiency. This suggests that Germany focuses on technologically advanced yet competitively priced nonwovens, catering to diverse industrial applications. The 0 per cent tariff rate further facilitates its export potential, strengthening its position in global markets.

Mexico

Mexico, with an export value of $30.39 million, leverages its proximity to the US market, ensuring logistical advantages and trade efficiency. Despite having the lowest RCA among the top five exporters at 4.87—indicating moderate competitiveness in the nonwoven textiles sector—Mexico maintains a strategic position. Its UVR of $4.50/kg, slightly higher than China’s, suggests a focus on value-added products rather than pure cost efficiency. Additionally, the current 0 per cent tariff rate strengthens Mexico’s exports, solidifying its role as a key supplier to North American markets. However, this dynamic may shift after April 2, 2025, if the US imposes tariffs on Mexican textiles or if the USMCA agreement is nullified, potentially impacting trade flows and competitiveness.

South Korea

South Korea, ranking fifth in exports with a total value of $26.49 million, maintains a strong competitive position with an RCA of 15.96, indicating specialisation in nonwoven textiles. Its UVR of $8.87/kg is higher than Germany’s and significantly above China’s, reflecting a focus on mid- to high-end product offerings. This suggests that South Korea prioritises quality and innovation in its non-woven textile exports. The 0 per cent tariff rate further enhances its market accessibility, supporting its role as a key player in the global nonwoven textiles trade.

Competitive landscape and outlook

Tariff-free market

All five countries were benefitting from a 0 per cent tariff rate, indicating an open trade environment for nonwoven exports. Now, China has been subjected to a tariff rate of 20 per cent. The nonwoven fabric trade landscape is dominated by China in terms of volume, but other countries like Japan, Germany, Mexico and South Korea compete on pricing and specialisation. High export prices of countries like Japan indicate market differentiation strategies. Germany’s mid pricing may indicate an emphasis on cost leadership strategies while exporting quality non-wovens to the US.

Diverse market strategies

Mexico focuses on cost-efficient production. Japan leads in premium-priced, high-value nonwovens, while Germany and South Korea balance quality and cost-effectiveness.

To sum up

The global nonwoven textile market for HS-560394 is currently dominated by China in terms of volume. However, the additional duty imposed by the US is expected to weaken its competitive pricing advantage. Mexico might benefit the most from the tariff imposition on China but will ultimately lose this advantage after April 2, 2025, as announced by US President Donald Trump. However, trade dynamics concerning volume in this category are likely to shift in favour of Japan, Germany, and South Korea, which may capitalise on the changing market conditions to strengthen their positions.

Fibre2Fashion News Desk (NS)