Major Indian exporters

Leading Indian textile and apparel exporters are among the foremost beneficiaries:

The UK-India FTA is set to boost textile and apparel trade by removing tariffs, enhancing competitiveness for Indian exporters, and lowering costs for UK retailers.

Large firms and SMEs alike can benefit through strategic partnerships, compliance, and innovation.

The deal fosters complementary strengths, driving sustainable, long-term trade growth.

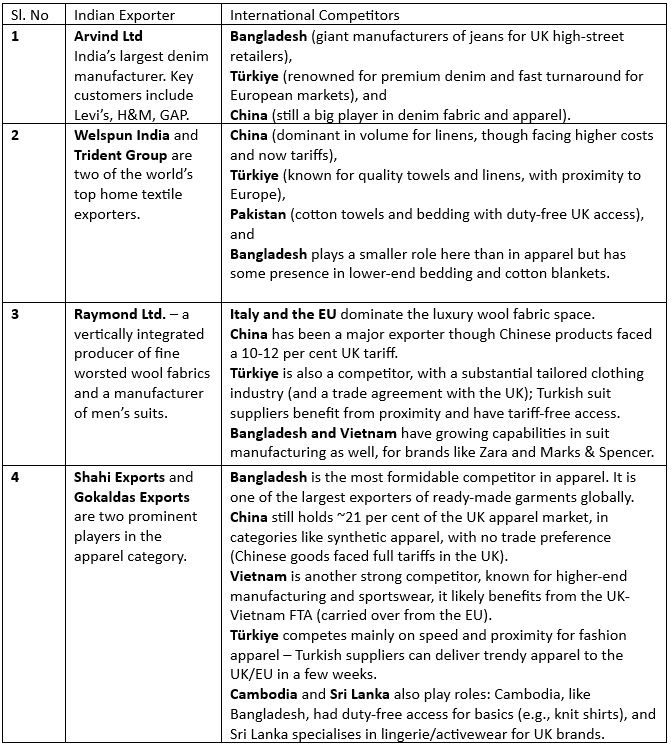

Table 1: Indian exporters and their competing countries.

Source: TexPro, F2F Analysis

All Indian companies mentioned in Table 1 have the scale, compliance infrastructure, and established UK buyer relationships to capitalise quickly. With tariffs eliminated, these companies can secure more competitive contracts, expand order volumes, and even consider investing in UK-based design, warehousing, or marketing subsidiaries.

Additionally, industry hubs like Tiruppur (Tamil Nadu) for knitwear and Ludhiana (Punjab) for winterwear are likely to experience a broad-based uplift. These clusters, dominated by SMEs and mid-sized firms, are well-equipped to fulfil bulk orders from UK retailers under the new favourable tariff regime.

UK retailers and fashion brands (import side)

Major UK fashion retailers sourcing from India are among the clear winners.

Table 2: UK-origin top apparel companies and their supplier details

Source: TexPro, F2F Analysis

The firms mentioned in Table 2 will benefit directly from lower landed costs, estimated to reduce import prices by up to 10 per cent. This margin relief can be used to either improve profitability or offer more competitive retail pricing. Fast-fashion giants like ASOS and Boohoo, which rely heavily on cost efficiency and speed, are expected to ramp up sourcing from India. UK-based wholesale importers will also benefit from duty-free trade, expanding their sourcing base at better rates.

Small and Medium Enterprises (SMEs)

SMEs represent the backbone of the textile sector in both India and the UK. The FTA opens new doors for:

Indian SMEs: Small garment manufacturers, power loom units, and artisan clusters can integrate into global value chains either directly or via larger exporters.

UK SMEs: Boutique fashion brands or technical textile startups can begin sourcing from India or exporting niche products to the Indian market, leveraging the cost advantage and growing demand.

Policy support—through trade finance, quality certification, and matchmaking platforms—will be key to enabling these SMEs to realise the FTA’s benefits.

Trade promotion bodies and regulators

Organisations tasked with facilitating exports and guiding industry compliance will play an important role in realising FTA gains:

India: Apparel Export Promotion Council (AEPC), Confederation of Indian Textile Industry (CITI)

UK: UK Fashion & Textile Association (UKFT)

These bodies will be instrumental in organising visits of trade delegations, hosting events like Bharat Tex 2025 (which explicitly targets UK-India connections), and educating exporters on origin rules and regulatory standards. Additionally, government departments—such as India’s Ministry of Textiles and the UK’s Department for Business and Trade—will be responsible for monitoring implementation, resolving disputes, and issuing clarifications on compliance.

Strategic recommendations for stakeholders

Large exporters are well-positioned to benefit immediately from the UK-India FTA due to their established networks and operational scale. They are expected to account for the lion’s share of the expanded trade volumes in the short term. However, small and medium enterprises (SMEs) also stand to gain significantly, provided they receive the right support. With adequate assistance in trade finance, compliance training, and buyer outreach, SMEs can integrate into global value chains. For instance, a small Indian fabric mill may begin supplying UK fashion brands via collaborations with larger garment exporters. Over time, such exposure could catalyse the transformation of promising SMEs into major exporters.

To maximise the benefits and navigate challenges under the FTA, Indian and UK businesses must adopt targeted strategies:

1. Act Swiftly on Tariff Gains

Exporters should promptly recalibrate pricing to reflect zero-duty access. Indian firms can offer more competitive FOB prices to UK buyers, potentially boosting volumes. UK brands, on the other hand, should consider passing tariff savings to consumers via lower retail prices to build market presence quickly. First movers will have a decisive edge.

2. Ensure Rules of Origin Compliance

FTA benefits depend on meeting the rules of origin requirements. Exporters must verify that their products meet the minimum domestic value thresholds. For example, an Indian-made garment using Chinese fabric may not qualify for duty-free treatment. Businesses should consider localising inputs or exploring cumulation options where permitted. Establishing dedicated compliance teams or seeking expert guidance is highly recommended.

3. Compete on Quality and Sustainability

Increased market access brings intensified scrutiny. Indian exporters should focus on quality, reliability, and sustainability—key concerns for UK consumers. Compliance with labour norms and environmental certifications (e.g., GOTS, OEKO-TEX) will increasingly influence buyer decisions. Likewise, UK exporters should position their products on the strength of premium quality and heritage craftsmanship to appeal to India’s discerning market.

4. Diversify Product Portfolios

Companies should explore new product categories made viable by the FTA. Indian apparel firms may consider expanding into outerwear, lingerie, or niche technical textiles. UK firms can target underpenetrated Indian segments such as home décor fabrics or performance materials. Market research will be essential in identifying demand-supply gaps.

5. Forge Strategic Partnerships and JVs

Cross-border collaborations can amplify market access. UK brands can partner with Indian manufacturers for exclusive collections, while Indian firms can benefit from UK design expertise or retail distribution. Joint ventures also offer a route for SMEs to scale internationally. For example, a UK SME might design products while production is handled by an Indian partner, or vice versa.

6. Strengthen Supply Chain and Logistics

With trade volumes set to rise, optimising logistics becomes critical. Indian exporters could establish UK-based inventory hubs to improve delivery timelines. UK firms sourcing from India may consider local procurement offices. Additionally, both sides should leverage FTA provisions for faster customs clearance, such as through Authorised Economic Operator (AEO) programmes.

7. Target Government and Institutional Procurement

The FTA opens new public procurement avenues. UK textile firms can now compete in Indian government tenders (railways, hospitals, armed forces) for uniforms or technical textiles. Indian exporters should monitor UK public tenders—such as NHS procurements—for similar opportunities, particularly where ‘Buy British’ rules may be relaxed under the FTA.

8. Utilise Trade Promotion and Facilitation Schemes

Businesses should engage with export promotion councils, trade fairs, and FTA-specific awareness programmes. These platforms are particularly vital for SMEs to build networks and understand market expectations. Many governments also offer support for certification and compliance costs, which should be actively pursued.

9. Stay Alert to Policy Adjustments

While the FTA is operational, ongoing monitoring is essential. Safeguard measures could be triggered if import surges disrupt local markets. Additionally, UK climate-linked regulations such as CBAM (Carbon Border Adjustment Mechanism) may impact future textile shipments. Businesses should remain engaged with industry associations to stay informed and influence emerging policies.

10. Invest in Long-Term Capability Building

Sustainable gains require reinvestment. Indian firms should channel export proceeds into factory modernisation, automation, and workforce upskilling—especially in high-value segments like smart or technical textiles. UK businesses may focus on brand development and India-specific product innovation. The FTA offers more than just a cost advantage; it is a platform to elevate competitiveness and innovation.

Conclusion

The UK-India FTA marks a defining moment for the textile and apparel industries of both nations. It offers a transformative platform for Indian exporters—especially large, vertically integrated firms—to consolidate their presence in the UK market through enhanced cost competitiveness and duty-free access. At the same time, it presents a gateway for SMEs to go global, provided they receive the right institutional support in areas like compliance, capacity-building, and digital enablement.

The success of this trade partnership will rest on three strategic pillars: collaboration between Indian suppliers and UK buyers, compliance with evolving market standards, and customer-centric innovation to meet diverse UK consumer preferences. Those who invest early in strengthening these capabilities will define the new contours of bilateral trade.

Crucially, the FTA is unlikely to disrupt domestic production in either country. The UK and India offer complementary comparative advantages, with India excelling in cost-efficient, large-scale manufacturing, and the UK leading in design, branding, and high-value segments. As such, the agreement fosters not competition but convergence, paving the way for deeper integration of supply chains, greater retail diversity, and more sustainable sourcing practices.

In sum, the UK-India FTA represents more than a tariff-cutting pact; it is a strategic inflection point. For those willing to adapt and act with foresight, it promises not only export growth but a redefinition of global trade dynamics in textiles and apparel.

Fibre2Fashion News Desk (PN)