New Delhi:

Gensol Engineering, the beleaguered firm that came under market regulator Sebi’s lens for fund diversions and governance lapses, said that its independent director Arun Menon has resigned with immediate effect.

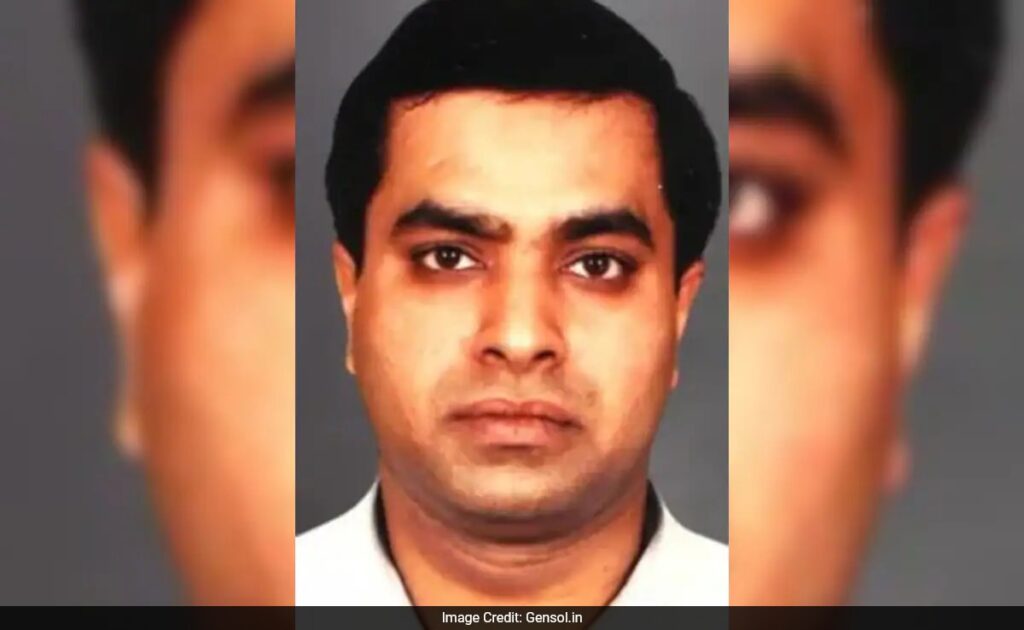

In his resignation letter addressed to Anmol Singh Jaggi, one of the promoters of the company, Menon said, “There was growing concern on the leveraging of GEL balance sheet to fund the capex of other business’s; and the sustainability of servicing such high debt costs by GEL.” Menon’s resignation came a day after Sebi on Tuesday barred Gensol Engineering and its promoters — Anmol Singh Jaggi and Puneet Singh Jaggi — from the securities markets till further orders in the fund diversion and governance lapses case.

The markets watchdog also directed Gensol Engineering Ltd (GEL) to put on hold the stock split announced by it and restrained the promoters from holding the position of a director or a Key Managerial Personnel in any listed firm.

The order came after the Securities and Exchange Board of India (Sebi) received a complaint in June 2024 relating to the manipulation of share price and diversion of funds from GEL and thereafter started examining the matter.

Arun Menon has tendered his resignation as the independent director of the company, with immediate effect, GEL said in a regulatory filing on Wednesday.

“Consequently, he shall also cease to be a member of various committees of the company,” it stated.

Menon has cited restrictions from his present employer as well as “adding limited value to the company” as reasons for his resignation.

“I would like to take you back to last year, July/August of 2024, when I had tried reaching you to seek clarity on the debt position of the company, and had also offered assistance to reduce the interest cost through a debt restructure route. While you had messaged me that you would call back, it never progressed,” he said in the letter to Anmol Singh Jaggi.

He further pointed out that he had “also spoken to Mr. Parmar (GEL’s company secretary Rajesh Parmar) on 2-3 occasions and asked him for a meeting with the CFO, which never seemed to materialise”.

“There was growing concern on the leveraging of GEL balance sheet to fund the capex of other businesses; and the sustainability of servicing such high debt costs by GEL,” read the letter shared by the company along with the latest filing.

“Since I felt I was adding limited value to the company, I had expressed last year to Mr. Parmar that I would like to put in my resignation, but was told to hold on till the IPO of Matrix is successfully concluded,” Menon said.

“My present employment, where our parent is a PE firm, also restricts me from taking up ID role in companies,” he added.

Further, he wrote in the letter, “I do understand these are difficult times for the company, and am confident that the learnings from the past would not only help you come out from the current predicament, but will help guide the company to greater heights.” As directed in the interim order, Sebi will appoint a forensic auditor to thoroughly examine the books of accounts of the company and its related entities.

“Gensol will fully cooperate with the forensic audit to be conducted at the behest of Sebi,” it had said earlier on Wednesday.

The company had further said that Anmol Singh Jaggi and Puneet Singh Jaggi are no longer participating in the management of the company as per Sebi’s instructions.

According to Sebi’s interim order, Gensol Engineering’s promoters treated the company as a proprietary firm, diverting corporate funds to buy a high-end apartment in The Camellias, DLF Gurgaon, splurging on a luxury golf set, paying off credit cards, and transferring money to close relatives.

According to Sebi, the company secured a total of Rs 977.75 crore in loans from IREDA and PFC, of which Rs 663.89 crore was meant specifically for the purchase of 6,400 electric vehicles (EVs). EVs were procured by the company and subsequently leased to BluSmart, a related party.

However, in a response submitted to Sebi in February, Gensol admitted that it had procured only 4,704 EVs till date — far less than 6,400 for which it had received funding. This was corroborated by Go-Auto Private Limited, the EV supplier, which confirmed delivering 4,704 units to the company for a total consideration of Rs 567.73 crore.

Given that Gensol was also required to provide an additional 20 per cent equity contribution, the total expected outlay for the EVs was around Rs 829.86 crore. By that calculation, Rs 262.13 crore remains unaccounted for.

(Except for the headline, this story has not been edited by NDTV staff and is published from a syndicated feed.)