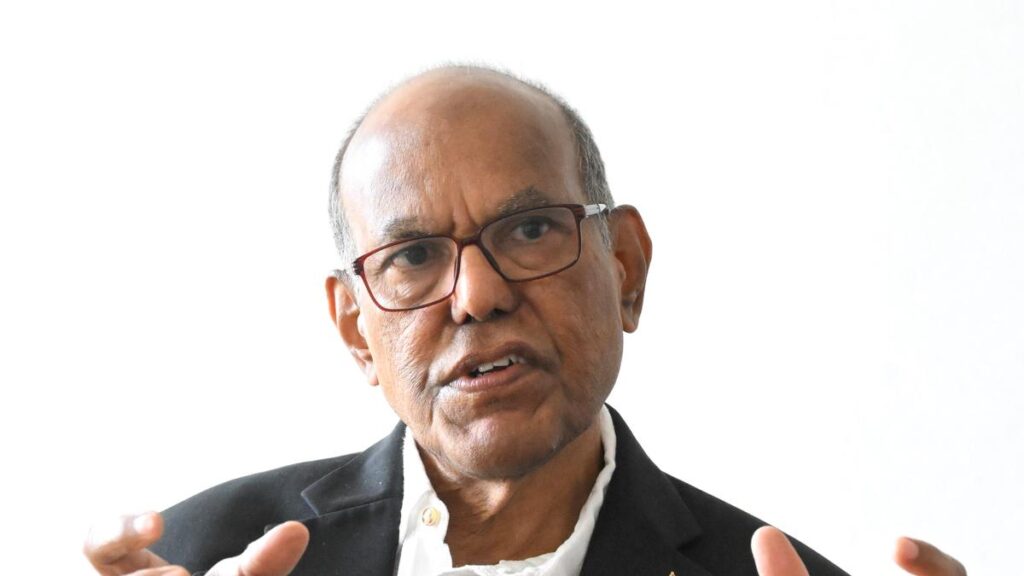

Former Governor, the Reserve Bank of India, Duvvuri Subbarao interacting with The Hindu in Visakhapatnam on Tuesday.

| Photo Credit: V. RAJU

It is time for both Central and State governments to have a rethink on the ‘freebie’ culture, as it is eating into the economy of the country and the States.

This was the opinion expressed by the former Governor of the Reserve Bank of India Duvvuri Subbarao on the freebie culture, in an exclusive interaction with The Hindu in Visakhapatnam on Tuesday.

‘’Not only Andhra Pradesh but almost all the States that have initiated the freebie culture, including the Centre, are struggling to balance between the ‘electoral promises of freebies’ and development. We are not sure whether the freebies are giving any electoral dividends, but they are surely hitting the State finances,’‘ he opines.

“In principle, freebies are being funded from debts, and as per the norms, the debt must repay itself. But if debts are used for current consumption and not asset creation, where will repayment come from?” he wonders.

Quoting former Chairman of the Chinese Communist Party, he says, “Teach a man to fish, rather than giving him a fish every day.’‘ The principle holds good here, as the Centre and the States have a huge burden of paying interest on the debts. Interest payment is the single largest expenditure for the Centre and the States and it is the fastest growing expenditure.

‘’Every political party is in this culture and it is time for the Centre to take a call and bring out a code of conduct and initiate a dialogue as the ‘Mother’ of the federal system,’‘ says Mr. Subbarao.

Monetary policy

Talking about the RBI’s monetary policy role, he says, “The monetary policy is primarily divided into three (aspects) — price stability, growth and financial stability in the country. All three hinge on inflation and the range of inflation is 4% plus or minus 2%, that ideally varies between 2 to 6%. If inflation is within range, then the RBI can focus on growth. If it is beyond the range, only then it needs to shift its focus on price stability.’‘

There is tension between growth and inflation only in the short term, and not in the medium and long term.

He also points out that monetary policy of the RBI has a long gestation period and it varies from one year to 18 months. The RBI under Governor Malhotra had recently cut the interest rate by 25 basis points, as they found the inflation was softening and the growth slowing. This cut in interest rate may not immediately translate into higher growth, but it will support growth in the sense that lower interest means people will consume more and investors will invest more in the long run.

Liquidity pressure

On the industries’ apprehension on the huge shortage of liquidity in the market, he says, “The straight forward option for the RBI is to ease liquidity. There are two variables in monetary policy – the price of money and the volume of money. The price of money is managing the Repo rate and the volume is based on liquidity management. But the basic problem now is the RBI is also managing the exchange rate. The conflict faced here by RBI is managing the monetary policy and managing the exchange rate simultaneously.”

On the RBI’s role in managing exchange rate, Mr. Subbarao says, “The basic responsibility of the RBI is to keep the exchange rate stable. It has to manage the exchange rate if there is excess volatility. Over the last two years, the RBI has been able to maintain a stable exchange rate, but in the last three or four months, it has allowed the rupee to depreciate. In my view, the RBI should be less interventionist. Because every time the RBI intervenes, the market participants will outsource the risk management to the RBI, as they know that the RBI will defend the exchange rate, which is not a good thing to happen. One thing I would say that one should not be fixated on the notion that a strong rupee is an indicator of a strong economy and a weak rupee is an indicator of a weak economy.”

There is a need for foreign capital to come in, preferably in the form of equity capital, long debt capital and direct investment, he feels.

Growth-oriented Budget

According to Mr. Subbarao, the latest Union Budget has put forward a strategy that might fuel growth. “In India out of 1.4 billion, the bottom 900 million are the drivers of economy. A lot depends on the purchasing power of the middle class and the lower income group. The tax cut might help in fuelling the growth, as consumption might grow. A lot depends on private investment and this consumption will trigger demand, which will have a positive impact on private investment. Till now, the government has been providing the infrastructure to lure the private sector, but the flow of investment has been slow, as the demand was low. Now the consumption might spur the demand,’‘ he explains.

Published – February 25, 2025 11:41 pm IST

Source:https://www.thehindu.com/news/cities/Visakhapatnam/it-is-time-to-have-a-relook-at-freebie-culture-says-former-rbi-governor/article69262466.ece