Amid continuing military tensions with Pakistan, Air India is exploring alternatives to replace Turkiye-based aircraft maintenance provider, Turkish Technic, following boycott calls sparked by Ankara’s support for Pakistan during last month’s cross-border strikes. Simultaneously, the airline has requested the government for $600 million annual subsidy to counter losses from flight disruptions triggered by Pakistan’s airspace closure since April.

“We are cognisant of the [public] opinion. As we can find alternatives, we’ll try direct aircraft there. It’s not an overnight or easy solution.” Air India CEO Campbell Wilson told The Hindu in response to a question on whether the airline would revisit its agreement with Turkish Technic amidst calls for boycott.

The airline sends its Boeing 777, legacy as well as those leased from Delta Airlines and Etihad post privatisation, to Turkiye for maintenance operations. The airline is already grappling with a delay in the retrofit of its legacy narrowbody and widebody aircraft, and a complete retrofit or refurnishing of its 13 legacy Boeing 777 now stands postponed with the aircraft set to undergo a limited “heavy refresh” next year that involves new carpets and seat covers.

“We’ve got a number of widebody aircraft that require maintenance, including the refit. There isn’t the capacity in India to do that for wide-body aircraft and we’ve had to farm aircraft out to AIESL [Air India Engineering Services Limited- a government-owned MRO]. Obviously, they can’t do all of it. We’ve sent some to Abu Dhabi, some to Singapore, and indeed some to Turkish,” Mr Wilson explained.

Air India’s low-cost arm, Air India Express, too has an agreement with the Turkish company for component support and solution needs of 190 Boeing 737 aircraft, that include services such as component pooling, repair, overhaul, modification, and logistics services of Turkish Technic.

Recently, the DGCA also said that IndiGo has until August 30 to terminate its agreement for leasing two widebody Boeing 777 aircraft from Turkish Airlines which the former has been using since 2023 to provide flights to Istanbul from Delhi and Mumbai after technical challenges in using its own narrow- body Airbus A320 and A321 that had to either take a mid-way fuel stop or carry less than the full load of passengers. The government has also revoked Turkish ground-handling company Celebi’s security clearance across airports.

But the impact of the military tensions on Indo-Pak border for two of the biggest airlines in India don’t end here. Air India has also sought $600 million subsidy from the Indian government for every year Pakistan’s airspace remains shut for Indian aircraft as it is forced to re-route its flights to Europe and North America and take a fuel-stop in Vienna for flights to Toronto, Washington DC, Chicago resulting in upto three hours of additional flight duration for some.

“At the time, that was our assessment of what the cost would be,” Mr Wilson said in response to a question. The demand was made after the government asked airlines to share their assessment of the impact of the airspace closure.

Air India’s flights are also grappling with an impact on passenger and cargo capacity in some cases.

“In order to operate non-stop with a longer flight route, we can’t fill all of the seats or all of the cargo capacity,” the airline CEO said. As many as 20-30 seats have to be flown without passengers on some flights.

“We’re getting better at optimising the flight route and mitigate the impact on our customers, operations and finances,” Campbell added.

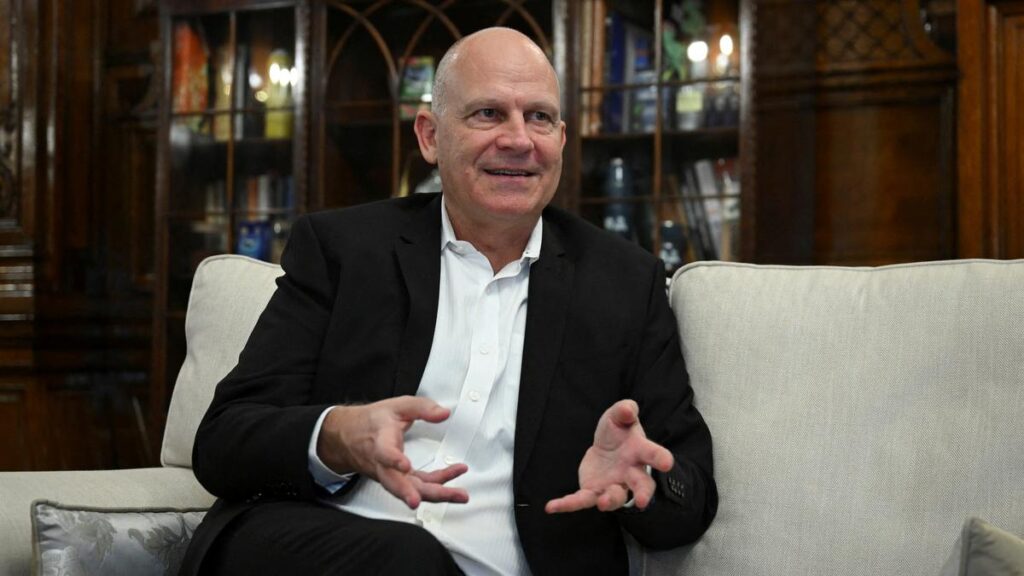

Air India’s CEO Campbell Wilson speaks with Jagriti Chandra on a wide-ranging issues, including the impact of the closure of Pakistan airspace, the airline’s financial performance, developing Indian airports as hubs, its partnership with Singapore Airlines as well as the airline’s role in Indian aviation.

With the U.S. government cracking down on immigrants, including halting visa appointments for foreign students and revoking citizenship, what is the impact of travel demand on your flights between Indian and the US.

I wouldn’t want to comment on those developments specifically. But there’s a few other external events that have an impact on the U.S, operations, particularly the airspace constraint that we have to fly around. This has caused reduction in the payload, and in a couple of cases an enroute refuelling stop. So, it’s hard to isolate one action from another but overall we still see very strong demand between India and North America bear in mind though that we’re operating slightly less capacity because of the payload restrictions.

What is the impact on capacity on these flights?

It very much depends on the flight, and the day as it depends on the wind conditions of each day. It’s a very dynamic situation. In some cases, we’ve actually been able to restore a lot of the capacity that we had originally cut as we are getting better at optimising our flight route.

Initially, we took an intermediate refuelling stop on a number of routes, but we’ve since been able to reoptimise the flight paths such that we have reinstated non-stop service to nearly all of the cities in North America that we were previously operating to. Only Chicago, Washington DC, Toronto and San Francisco continue to be the ones to have a refuelling stop, which in some cases is only in one direction.

On some North America routes as many as 20-30 seats have to be dropped, or there is a reduction in cargo capacity.

You have earlier spoken of aircraft deliveries remaining slow in 2025. How many aircraft are you adding this year.

The capacity growth for the last financial year was about 12% for Air India. This year it is going to be flat because we are only getting a couple of wide body deliveries. These include a Boeing 787 and an Airbus A350. But we are also taking out a number of the legacy aircraft in order to have their interiors completely refitted.

In the financial year 2024 you were able to reduce losses by 60%. What do you think were the factors that contributed to that and how was your financial performance in financial year 2025?

One of the factors was a significant increase in revenue. Revenue can come from expansion, but there is also the quality of revenue, which is revenue per kilometre which is from entering new markets, improved revenue management, improving pricing practice, ancillary revenues, cargo revenues, product improvement, attracting different clientele than you might have carried in the past. On the cost side, it’s efficiency of deploying aircraft, IT systems for scheduling aircraft and scheduling crew. Next is the scale that comes with the benefit of reducing your unit cost. There was a real technical, product and training debt that we had to overcome. So, we have had to invest a lot in that to bring things quickly back to what we consider a more acceptable level. We have had to also build an infrastructure that supports not the sub-100 aircraft fleet that Air India used to have, or the 300 aircraft fleet that we now have, but the 500 aircraft fleet that we’re going to have in three years time. So, we are incurring some costs there which will have benefit for future and allow us to lower the unit cost over time. So, it’s very much transitioning at the moment. Whilst we’re seeing progress, there are a lot of moving parts. And we don’t want to be pennywise, pound foolish in robbing from the future to achieve numbers now. The company did that before.

But how do you expect the financial year that has just ended to perform? Do you expect to better in terms of cutting down on losses?

Certainly on the full service carrier side, we’re very happy with the trajectory. It has been a good progress. The low- cost carrier went from 25 aircraft to over 100 aircraft in a very short span of time, and that rate of growth was quite astonishing. So, it does take a while to digest and optimise and they have a little bit more work to do.

There is a concern from your long-haul international travellers who have to connect from cities like Hyderabad or Chennai or Cochin, who say they would prefer to fly either through Dubai or a European hub rather than take a connecting flight in Delhi and Mumbai which are inconvenient connecting points. Are you planning to address some of these pain points?

I agree 100% on the connection experience for people travelling from within India. It’s not as smooth as as I would like it to be. And there’s a few reasons for that, including the security protocol that passengers need to go through, which is a regulator-mandated process. There is also a baggage screening process. In some cases it’s language, and people are not comfortable speaking Hindi. So, we are working with the airport operator and the Ministry on how we might make this process simpler because we think it’s actually in India’s benefit. The more people that are transiting through an Indian hub on Indian soil benefits the Indian ecosystem, not just the aviation ecosystem.

What are the specific suggestions that you’ve made?

There was previously a regime called hub and spoke, and its reintroduction would be that someone coming in from a domestic point would go through a slightly different screening process, or go through an internal channel. Additionally, the customs and immigration can be done at the originating station instead of the hub station. That’s how we can remove the friction and become comparable to Dubai or Qatar.

What are the benefits of the Singapore Airlines partnership for Air India. Does the route expansion happen in conjunction with them?

We are not constrained in where we want to fly to because of that relationship. The partnership with Singapore really allows us to to serve cities that really we aren’t able to fly viably ourselves from India. They have 20 something destinations in Indonesia, and multiple destinations in Philippines and Malaysia. They also fly to seven or eight cities in Australia and New Zealand. In the medium term, we’re not going to be able to operate to even half of those cities non-stop from India India ourselves and their partnership expands our reach to that part of the world, and then expands their reach into India and beyond India. Because of the strength they have in their markets, they can provide a distribution and sales network in Asia and Australasia that we don’t have and we can do the same thing for Middle East and India.

Are there also other aspects such as training, maintenance and operational aspects where their partnership will be of help to Air India. Will there also be manpower deputations between the two airlines.

A lot of the inputs they’ve given is directly through Vistara. There were a lot of Singapore Airline processes and that was embedded in Vistara, and with the merger of the four airlines we have adopted the best practises from all those four airlines. Singapore Airline has also been very helpful in advising on engineering. We’re working formally with SIA Engineering Company on the development of our maintenance, repair and overhaul base in Bangalore. And obviously now they have a 25% shareholder representation on the board. There is also information exchange, exchange of best practises exchange and deputation of people to be familiarised in both directions, which allows the two companies to corporate well together. Apart from representation on the Board, there are no deputation rights into Air India for Singapore Airlines.

Since Air India’s privatisation in January 2022, there has not just been new orders for 470 aircraft but also investments announced for pilot training, strengthening MRO capabilities. How do you see Air India’s role evolving in the Indian aviation as well as the global aviation ecosystem over the next decade or so.

I think the word I would use is key catalyst. Each flight that we operate has an Indian crew, and is supported by Indian engineers, and Indian ground-handlers. And the maintenance base that we have will facilitate original equipment manufacturer component providers and the people that we bring on our flights are going to be doing business with Indian businesses and building connections. So, the stronger we can make that Indian aviation ecosystem, the more the catalytic and multiplier effects on the rest of the Indian economy and society get strengthened. But it really comes from the airline’s investment in the aircraft in particular, in network, in quality, and subsequently in all the support infrastructure. It’s no secret that if you look around a number of the countries in the region, the perception of the country is driven by the perception of the airline in some respects. You can look west, you can look east. That’s what I think, ultimately we want it to be. That when people see Air India, people can see that the attributes of Air India are India.

Published – June 01, 2025 06:01 pm IST

Source:https://www.thehindu.com/news/national/interview-air-india-ceo-says-airline-looking-to-replace-tie-up-with-turkish-aircraft-maintenance-company/article69645240.ece