If you are a resident of Ahmedabad and are thinking of buying a property there or already owe one, you should know about the AMC Property Tax Ahmedabad. It is a mandatory annual tax that people must pay when they own a property in Ahmedabad. This tax is crucial for funding infrastructure, sanitation, and civil amenities. Property owners must pay the tax annually, with rebates available for early payments.

You can access your Ahmedabad Municipal Corporation tax bill online through the AMC website and pay the dues digitally. Late payments are penalized. The amount of the tax depends on the property, type, area, structure, and location. People can also apply for exemption under specific conditions. Visit the AMC portal to check, pay, and download the AMC tax bill. This blog will teach you about the AMC house tax bill and other required information like paying timely to avoid legal charges.

The AMC Property Tax: What is it?

About the Property Tax of the Ahmedabad Municipal Corporation

The Bombay Provincial Corporation Act created the Ahmedabad Municipal Corporation (also known as Amdavad Municipal Corporation). The company is renowned for reforming property taxes and has just created an online payment system. The Ahmedabad Municipal Corporation, or AMC, was created in 1950 following the Bombay Provincial Corporation Act and is in charge of the city’s administration and civic infrastructure.

Unbeatable Price 5-Star Rated Partner! 2200+ Shades! Top Quality Paint Free Cancellation!

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

The company is renowned for starting many ground-breaking projects, such as issuing municipal bonds and enacting property tax reform while maintaining a “zero litigation” record. By getting in touch with the Ahmedabad Municipal Corporation, you can pay all your property-related taxes in Ahmedabad.

What is the Tenement Number?

A tenement number is a unique identifier assigned to a specific individual unit within a larger building, most commonly seen in India. It’s essentially an apartment or unit number within a tenement building.

How to find your Tenement Number

If you are trying to find your tenement number for property tax, then you can simply use the AMC Tenement search at the Ahmedabad Municipal Corporation (AMC) website at https://ahmedabadcity.gov.in/. Visit the website and add relevant details like address, ward number or owner information. This number is crucial for paying Ahmedabad Municipal Corporation Tax, verifying ownership and other documentation to ensure the details are accurate for a successful search.

Ahmedabad Property Tax Login 2025

Ahmedabad property owners can pay tax online through the Ahmedabad Municipal Corporation’s portal. Login in 2025 to conveniently view, pay, and manage property tax details.

List of Civil Centers for Offline Property Tax Payment

Below is the list of some of the civil centres in Ahmedabad in different zones like Central, East, North West, South West, North, South and West that you can visit for offline property tax payment:

| Ward | Civil Centre Name | Address | Contact Person | Contact Number | Timings |

| Jamalpur | Sardar Bag | Nr. Air India Office. Opp. Sardarbag, Ahmedabad | Vinod Patel | 9726416169 | 9:00 am to 4:30 pm |

| Dariapur | Relief Road | Opp. Rupam Cinema, Relief Road Ahmedabad | Vinod Patel | 9726416169 | 9:oo am to 7:30 pm |

| Shahibag | Dudheswar | Dudheswar Sub Zonal Office, Dudheswar Water Works Compound, Shahibaug | Monaliben Patel | 9726416154 | 9:00 am to 4:30 pm |

| Khadia | Khadia | Angadia Octroi Post, Opp. Mahipatram Ashram, Besides Raipur Gate, Kahdia Ahmedabad | Hansaben Amaliyar | 9099083077 | 9:00 am to 4:30 pm |

| Odhav | Odhav | Odhav Ward Office, Near Rabari Vasahat, Beside Odhav Fire Station, Odhav, Ahmedabad | Chirag Trivedi | 9726416155 | 9:00 am to 4:30 pm |

| Bodakdev | Bodakdev | Nr. Atithi Dining Hall, Nr. Deep Tower, Inside Shradhdha Petrol Pump, Bodakdev, Ahmedabad | Deepak Patel | 9712967313 | 9.00 am to 7.30 pm |

| Vejalpur | Vejalpur | Vejalpur city civic center, beside venus, Butbhawani mandir Road, Vejalpur, Ahmedabad | Binakumari Bhatt | 9726416179 | 9:00 am to 4:30 pm |

| Sardar Nagar | Sardar Nagar | Sardarnagar Library Bhavan, Near Sardarnagar Police Station, Sardarnagar, Ahmedabad | Bhalaji Rathod | 9726416134 | 9.00 am to 4.30 pm |

| Indrapuri | Indrapuri (Bagefirdaush) | Indrapuri Ward Office, Nr. Express High-Way, C.T.M. Cross Road, Ahmedabad | Palakben Panchal | 9726416138 | 9.00 am to 7.30 pm |

| Vasna | Vasna | Vasna Swimming Pool Building, Opp. Godavari Flat, Vasna, Ahmedabad | Leenaben Patel | 9924087768 | 9.00 am to 4.30 pm |

Here’s the process for Ahmedabad property tax login 2025:

- The AMC system uses a mobile number and OTP (One-Time Password) based login.

- Enter your registered mobile number for the property.

- You’ll receive an OTP on your phone via SMS.

- Enter the received OTP in the designated field on the login page.

- Click “Login” or “Submit” (depending on the website’s wording).

Once logged in, you should be able to access functionalities like:

- Viewing your current property tax bill

- Making online payments

- Downloading payment receipts

Ahmedabad Property Tax Online Payment 2025

By going to the Ahmedabad Municipal Corporation website, you may now be able to pay your online property tax payment in Ahmedabad. To pay your property taxes, you don’t need to go to the Ahmedabad Municipal Corporation office in person. The company provides online property tax payment services to make paying your property tax easy.

These steps must be followed to pay your property tax online:

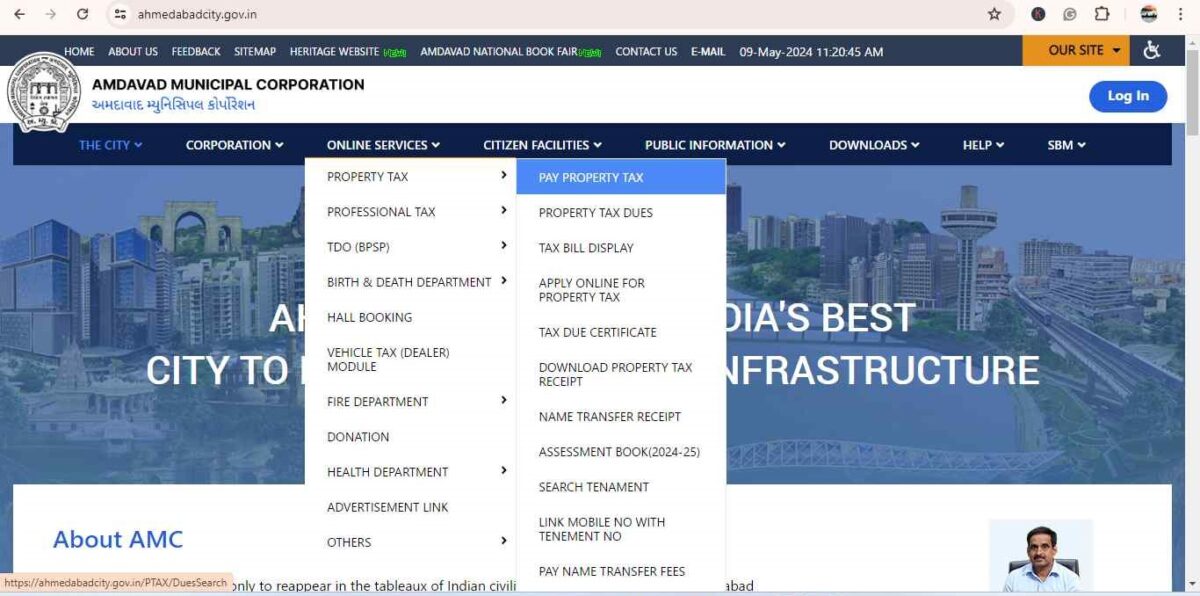

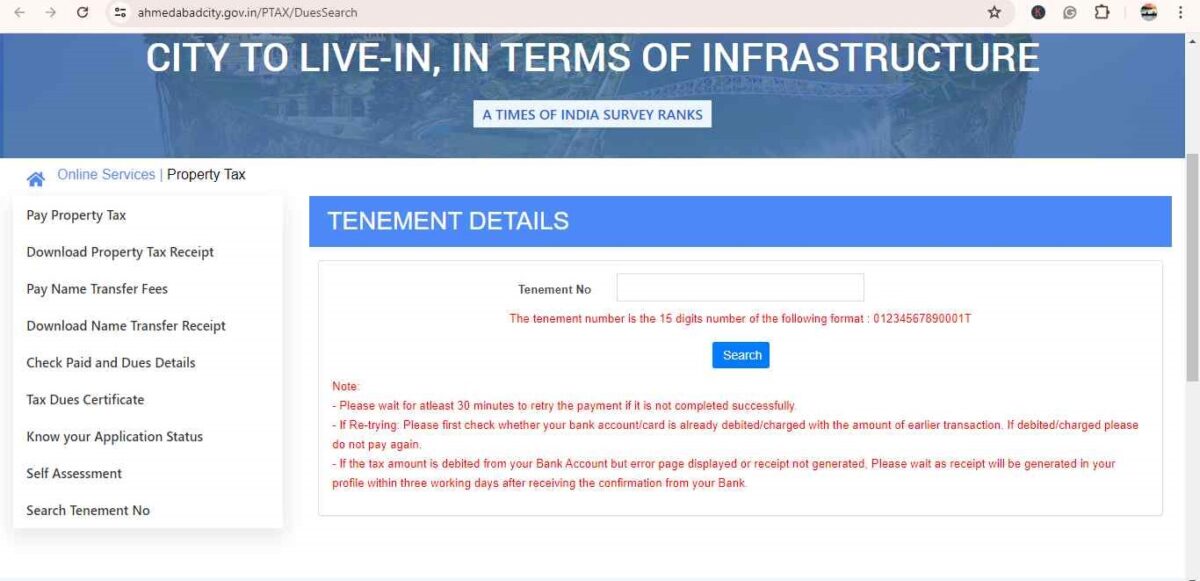

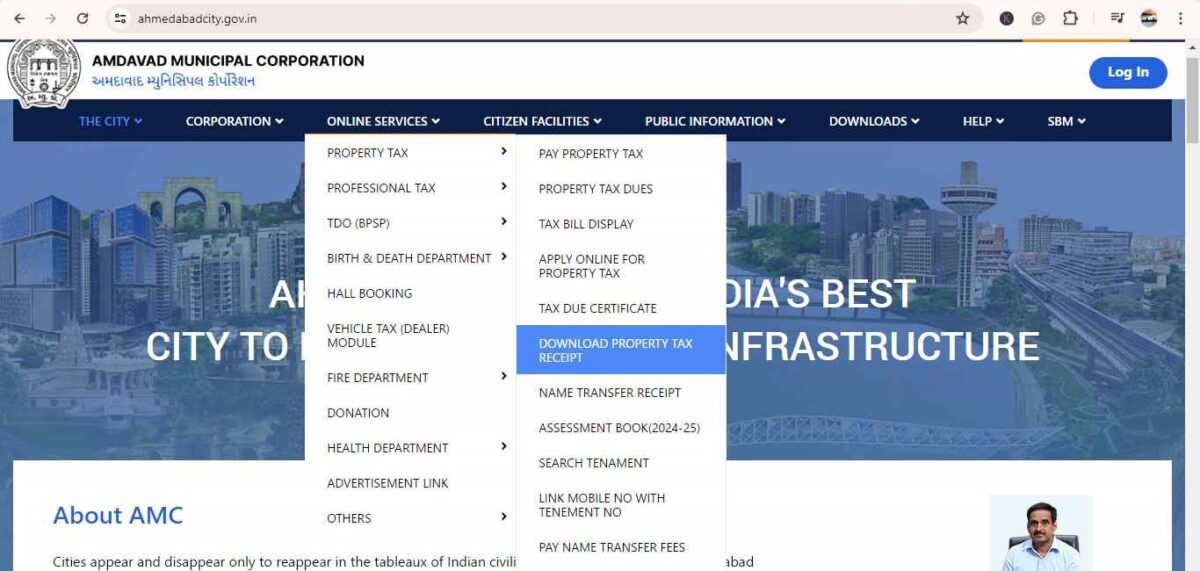

Step 1: Go to the Ahmedabad Municipal Corporation’s official website (https://ahmedabadcity.gov.in/) and select “Online Service (Without Login) -Tax department – Pay Property Tax.”

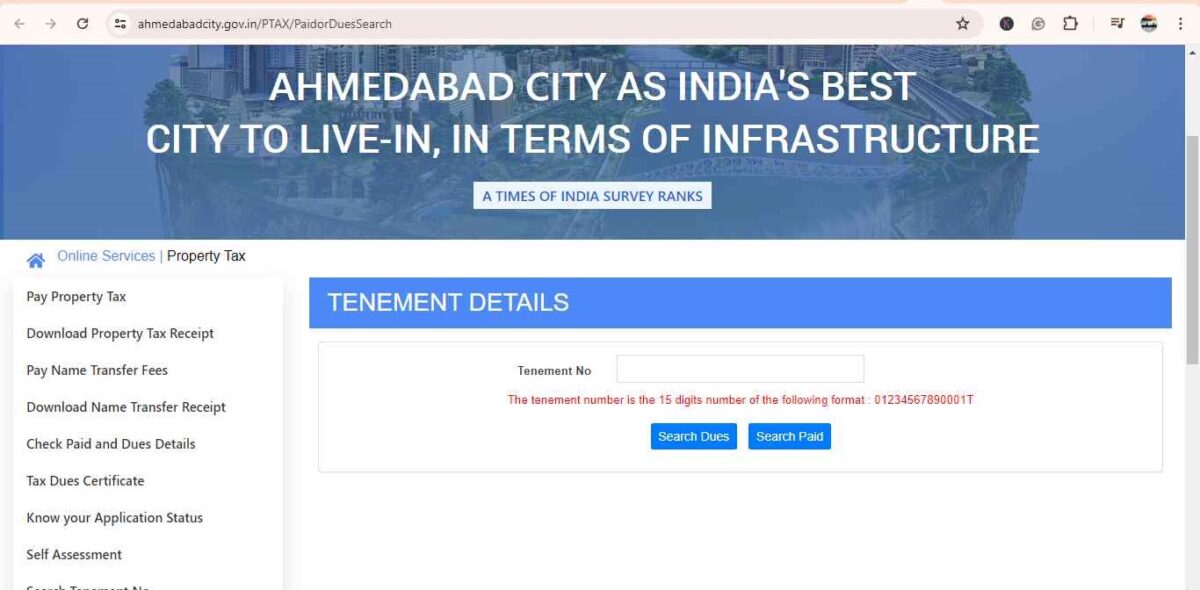

Step 2: Enter your tenement information on the website. Therefore, enter the Tenament Number and press “Search.”

Step 3: Following that, you will see the owner’s name, address, occupier (if any), and the outstanding balance. To begin payment and pay the outstanding tax amount, click the “Pay” option.

Step 4: Clicking the “Pay” button will take you to a new website that contains information about your tenancy and the payment amount. On the same page, you must enter your phone number or email address. Afterwards, select “Confirm.”

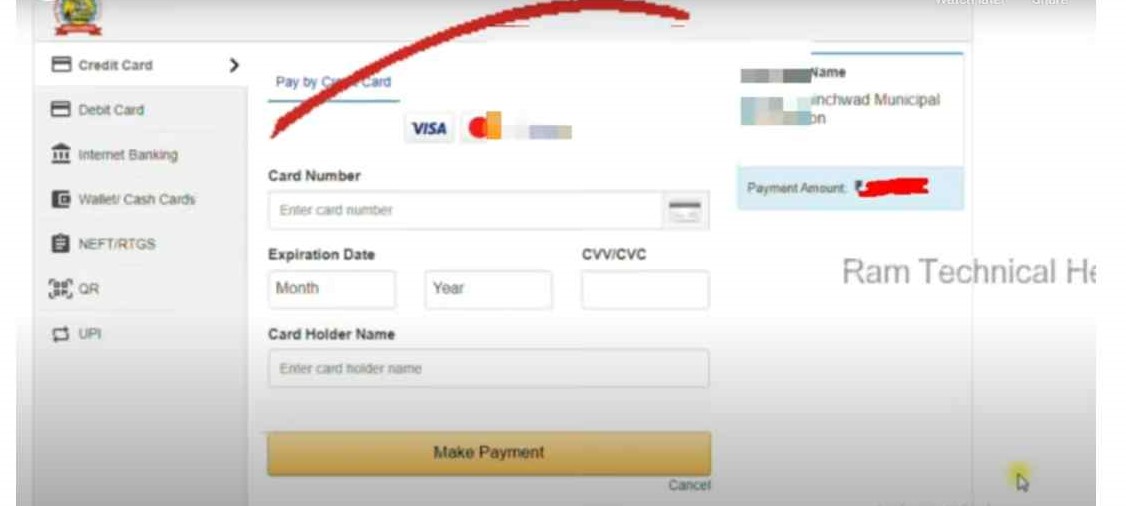

Step 5: You will be taken to a payment gateway, where you must enter your credit card information after clicking the “Confirm” button. You can also use a debit card to pay.

Step 6: Your credit or debit card account will be promptly deducted when you pay using one of these methods. You will obtain a Transaction Reference Number as confirmation of your transaction.

Step 7: Your money will be credited to Ahmedabad Municipal Corporation’s account immediately or within two business days.

Step 8: The AMC website will make the payment receipt available, or you can also get it by email.

Ahmedabad Property Tax Offline Payment 2025

Those without internet access can pay the tax at several city civic centres across Ahmedabad.

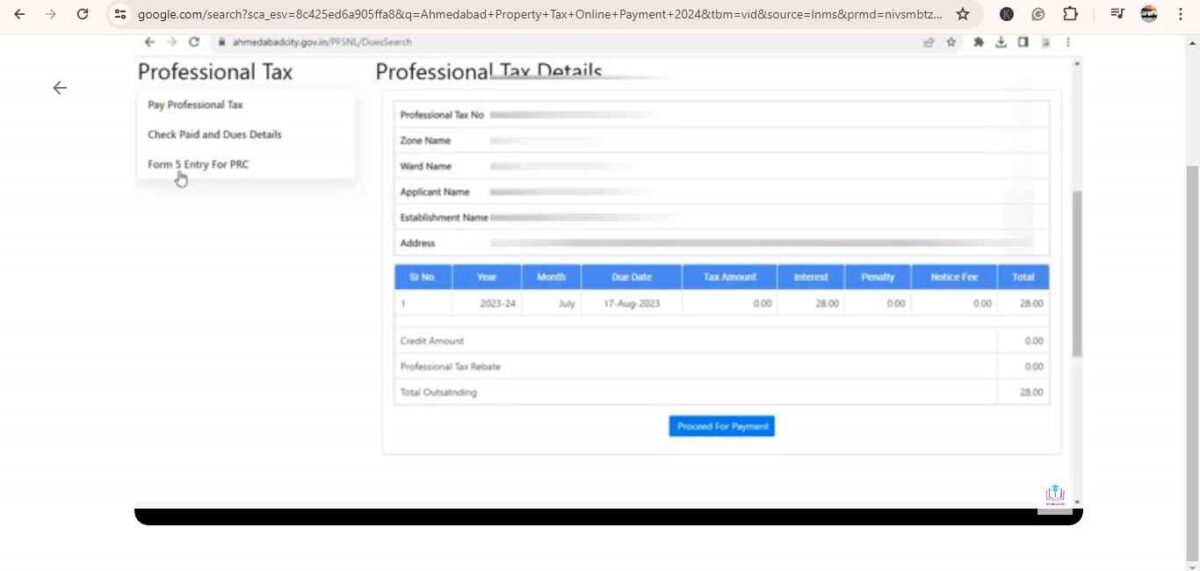

Options for Online Process Payment

Three payment options are available for the Ahmedabad Municipal Corporation property tax online payment process. You can decide on the option that best suits your needs. The choices are:

- Credit Card

- Debit card

- Internet banking

One must also be aware that the payment gateway may charge the bank in addition to the cost that must be paid when making an online purchase. That is to say, and a tiny amount will be added to the current tax charges.

Ahmedabad Property Tax Payment Receipt 2025

Property owners should download the receipts after the online payment is complete. You could look up your property tax receipts online if you forgot to download them. To generate a payment history, choose “Property Tax” from the Service Name drop-down menu and input the tenement number. To produce a preview and download the receipt, click the “view” link.

How To Search for an Ahmedabad Tenement Number?

When a property is registered, a unique identifying number called a “Tenement Number” is given to each property. When fulfilling their tax obligations, property owners must provide this number. To look up the tenement number for your property, go to the official website. You can search for your property using the zone, owner, ward, or occupier information.

Property Tax under AMC: Self-assessment

To access self-assessment, click on the Tax Department’s official website link. Enter the factor details in this field, including

- The property types

- Tax rate

- Usage factor (building group, usage code, building type, and usage type rate)

- Location factor (land value)

- The occupancy rate (type of occupancy, occupancy factor rate, government building, water zone)

- Occupancy factor details

- Discount rate

- Construction year

- Age factor rate

- Carpet area

- Total area

Click on “Evaluate Tax” to acquire an approximation of the AMC property tax due.

Assessment Book for The Ahmedabad Municipal Corporation for 2024–2025

The AMC’s assessment book is a comprehensive record that provides details of the property assessment within the city’s jurisdiction. This document is important for property owners to get information about property valuation, tax liabilities, etc. To get the assessment book for the 2024-2025 fiscal year on the Amdavad Municipal Corporation, go to the website, enter the tenement number and click on search.

How to Access Ahmedabad Municipal Corporation Property Tax Auction.

Click on the property tax auction notice under Downloads to view the AMC property tax auction notice. The notice you want to check will download to your computer when you click on it.

Ahmedabad Municipal Corporation Property Tax Bill Download.

Under downloading, select “Forms and Fonts” to obtain the various Ahmedabad property tax bills by going to the official website and clicking on the link. A list of forms can be found under “Property Tax” on this website. The form you desire will be downloaded to your computer as a PDF when you click on it. Scroll down the page to access all forms on the Ahmedabad Municipal Corporation website, including the property tax in Ahmedabad and the return declaration form under AMC forms.

AMC Property Tax: Current Information on Citizens or AMC Property Tax Name Change Online

You can update your AMC property tax website information by completing the available form.

Visit the official AMC property tax bill search by name. On the form, you can enter your email address, full name, cell phone number, tenement number, and electrical service number and submit it.

Ahmedabad Property Tax Calculator 2025

The AMC property tax is computed based on a property’s capital value. Since its implementation in 2001, this calculation method has considered the following elements: the property’s location, kind, age, and use in Ahmedabad.

The following formula is used to calculate AMC property tax manually:

Area x Rate x X equals property tax (f1 x f2 x f3 x f4 x fn)

Where,

f1 = the importance of the property’s location.

f2 = weighted consideration of the property type

f3 = the weighting assigned to the property’s age

f3 = Residential buildings are given more weight (f4).

fn = the amount of weight given to the property’s user.

The values associated with the weights mentioned above are on the AMC’s website, which handles property taxes.

Ahmedabad Property Tax Rates 2025

The tax rates set in Ahmedabad depend on the property type. The table below highlights the different rates:

| Types of Properties | Property Tax Rates |

| Residential Property | ₹16 per sq m |

| Non – Residential Property | ₹28 per sq m |

AMC Property Tax Discounts and Rebates 2025

At the municipal corporation’s discretion, discounts on property taxes are occasionally advertised. As we have already discussed how to pay your AMC property tax bill online and offline, now you must be aware of the reductions and rebates the offers of the AMC property tax bill payment online. Let’s look at the discounts provided to property owners.

The Ahmedabad Municipal Corporation has increased the advanced payment rebate on property tax from 10% to 12%. Now, citizens can get an extra 1% discount for paying online and a 2% discount if they have paid advance tax for the last 3 years. In 2024-2025, the rebate was 10% for advance payment, with an additional 2% discount for online payment for the past 3 years and 1% for online transactions.

According to the AMC, they introduced an interest weaver scheme effective March 14, 2025, to March 31, 2025. This scheme is available only for 15 days. Under this scheme, residential property owners receive a 100% interest waiver on pending dues, and commercial property owners receive a 75% interest waiver.

Recent Developments for Taxpayers about AMC Property Tax

Recent updates for AMC property taxpayers include easier online payment options, updated tax slabs, and improved services. These changes aim to simplify the property tax process for Ahmedabad residents.

Ahmedabad Property Tax Last Due Date 2025

Residents who fall under the jurisdiction of AMC Property Tax Ahmedabad will pay property tax (first instalment) by March 31, 2025, and (second instalment) by October 15, 2025. If the time for AMC property tax bill payment online in Ahmedabad has passed, property owners must now pay the amount plus the penalty interest.

Ahmedabad Property Tax Rebate Scheme 2025

The Ahmedabad Municipal Corporation (AMC) standing committee has extended the deadline for the advance rebate programme for property tax payments online in Ahmedabad to March 31, 2025(first instalment) and October 15, 2025 (second instalment). According to the plan, customers who pay their AMC property taxes by March 31, 2025, will be entitled to a 12% discount.

The AMC tax collected between April 1 and July 15, 2024, increased by 50% compared to the same period in 2024. Property tax collections in Ahmedabad increased by Rs 153.68 crores, and the citizens’ response encouraged the city authority to prolong the rebate programme. As per the fiscal year 2025, the data has not been released publicly.

According to officials, the eastern parts of the city have seen a 70% increase in the amount of property tax collected by the AMC in Ahmedabad. The tremendous growth in the AMC tax bill, 90 per cent, was recorded in Viratnagar, Nikol, Gomtipur, Odhav, Vastral, and Amraiwadi. The collection from Ahmedabad’s centre zone and western regions has barely increased by 50%. The increase was observed in commercial property’s advance AMC tax bill payments.

The Department of AMC Property Tax Ahmedabad Seals Property for all Tax Defaulters

As per the latest news, on March 14, 2025, AMC sealed 2,338 properties of all the property tax defaulters in various parts of Ahmedabad. They have also instructed that if the due is not paid on time, water and sewer connections will be cut off for all these properties. On a single day, they sealed around 466 properties, collecting ₹32.70 lakh from the Southwest zone. And from the Easter zone, 1872 properties were sealed, leading to the collection of ₹58.87 lakh.

Civic Body Updates Budget but Doesn’t Increase Property Taxes.

For the fiscal year 2025-2026, the AMC standing committee has approved a budget of Rs 15,502 crores without increasing property tax. Also, they have increased the advanced payment rebate on property tax from 10% to 12% to encourage payment. Now, citizens can get an extra 1% discount for paying online and a 2% discount if they have paid advance tax for the last 3 years.

Vehicle, property, water, and conservancy taxes were also not increased. 100 per cent tax relief has been made available for all residential properties with a surface area of 40 square metres or less.

More than six lakh homeowners will be exempt from property tax, general tax, water tax, conservancy tax, and education cess. If they pay off their debt for 2023–24 between June 1 and August 31, 2024, they will be qualified for a 100% interest dues rebate.

As of March 18, 2025, no official announcement has been made regarding the property tax exemption in the theatre and fitness industry. Check out the official Gujarat government website for any recent updates.

Legal Services Offered by NoBroker

NoBroker provides comprehensive legal assistance tailored to property transactions. Here’s an overview of our services:

- Document Scrutiny: Our legal team examines essential documents like title deeds and sale agreements to identify potential issues before finalising the property deal.

- Protection Measures: We help safeguard you from fraudulent practices by checking for any existing legal disputes on the property and verifying ownership.

- Packages: NoBroker offers various legal service packages. These can include:

- Buyer Assistance: We provide guidance and support throughout the buying process.

- Registration: We handle property registration, saving you time and hassle.

- On-Demand Services: If you don’t need a full package, we offer specific services like property title checks, guidance on market value, assistance with missing documents, and verification of occupancy certificates.

- Free Consultation: NoBroker offers a free consultation to discuss your needs and provide initial legal advice related to property.

- NoBroker Pay: By using NoBroker Pay, you can ensure a secure and convenient way to make your KMC property tax payments. Additionally, you can track all your payments conveniently in one place.

How to Book NoBroker Legal Services

Here are the simple steps to secure our services for a smooth and hassle-free service:

- Step 1: Download/ Visit the NoBroker app.

- Step 2: Visit the NoBroker Legal Services page.

- Step 3: Explore the different service packages offered. We cover tasks like drafting agreements, property verification, and legal consultations.

- Step 4: Once you decide on a service, fill in the necessary details and complete the form.

- Step 5: Then our NoBroker experts will contact you for further details. This contact might be through a phone number or a chat window. You can also book a free consultation call for further enquiries.

- Step 6: NoBroker’s legal services page highlights its online rental agreements, which can be purchased and customised directly on the NoBroker website.

Why Choose NoBroker Legal Services

Here are some of the key reasons why you should choose NoBroker legal services:

- Convenience: NoBroker emphasises the ease of its service. You can complete legal tasks from your home without physically visiting a lawyer’s office.

- Affordability: We claim to offer competitive pricing on their legal services compared to traditional lawyers.

- Experienced Lawyers: NoBroker has experienced lawyers (minimum 15 years of practice) qualified by the Bar Council.

- Streamlined Process: We aim to simplify the legal process by offering pre-defined packages and handling communication with the lawyer on your behalf.

- Technology-Driven: NoBroker leverages technology for tasks like document management to improve efficiency.

Simplify Your Property Legalities with NoBroker’s Expert Assistance

Every year, Ahmedabad property owners must pay the AMC property tax. You may also be entitled to rebates if you make an advance payment. Additionally, it’s simple and handy because you can pay your AMC property tax bill online. Even from your smartphone, you can file your taxes easily. If you need professional help understanding AMC property tax and payment, consult experts at NoBroker. Choose NoBroker Pay for a secure and convenient way to make your VVMC property tax payments. This service lets you easily track all your payments in one place. Our user-friendly platform also simplifies the stamp duty process. Download the app today!

Frequently Asked Questions

Ans: Taxes for the Ahmedabad Municipal Corporation can be paid every six months. A penalty of 2% of the tax value every month until you make the payment will be assessed if you pay your taxes late or default. In these circumstances, the tax bill also states the penalty charge. The AMC property tax due details and final payment dates are March 31 and October 15.

Ans: Yes, you can pay the AMC property tax online via several methods such as credit card, UPI, net banking, debit card, etc.

Ans: Some institutions are exempt from paying property taxes. The Ahmedabad Municipal Corporation has announced the exclusion for the below-mentioned.

● Institutions of religion

● Sacred spaces

● Crematoriums

● Public restrooms

● Institutions of higher learning like Madrasa and Path Shala

Ans: AMC Property Tax is calculated based on several factors, including the carpet area of your property, location, type of building, age of construction, and occupancy status.

Loved what you read? Share it with others!

Source link