- Calibrated launches of new projects will keep overall inventory levels at comfortable level

- ICRA expects modest 1%-4% growth in area sold during FY2026

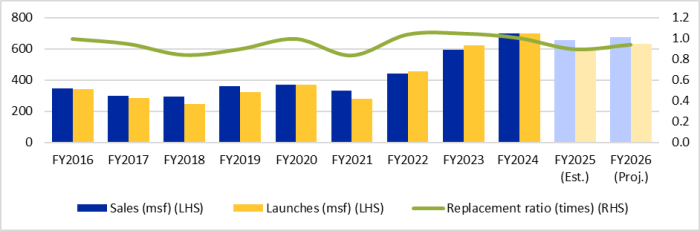

New Delhi, April 08, 2025: ICRA expects the new project launches in the top seven cities to grow by 6-9% in FY2026 to around 620-640 million square feet (msf), supported by the current low inventory overhang and some spillover of new project launches from FY2025. The launches are estimated to have sharply declined by 14-17% in FY2025 due to approval-related challenges, after reporting the highest ever at 701 msf in FY2024. The replacement ratio measured by launches to sales in the last 12 months remained at 1.0 times in 9M FY2025 and is likely to remain at similar levels in FY2025 and FY2026.

Giving more insights, Anupama Reddy, Vice President and Co-Group Head, Corporate Ratings, ICRA, says: “A material increase in average selling prices (ASP) during FY2023 to FY2025 will be a drag on affordability of buyers. However, lower income-tax along with policy repo rate cut of 25 bps in February 2025 and another 50-bps rate cut expected in FY2026 will be positive for the sector.“

“Area sold is likely to have declined by 4-7% in FY2025 to 650-670 million square feet (msf) due to lower launches, the impact of which is expected to spill over to FY2026 as well. ICRA expects the area sold in the top seven cities in India to grow by 1-4% in FY2026. Given the expected calibrated launches and adequate sales velocity, the years-to-sell (YTS) is expected to remain comfortable at 1.0-1.1 times in FY2025 and FY2026,” Reddy added.

Exhibit 1: Trend in annual sales, launches and replacement ratio in top seven cities

Source: Prop Equity and ICRA Research

The recent budgetary proposals are a positive for the sector. The reduction in income-tax in the Union Budget for FY2026 is likely to enhance disposable income for consumers and is, therefore, a positive for the affordable and the mid-income housing segments. The continued focus of the Government on the affordable housing segment, reflected in the higher allocation of 54% towards the PMAY-Urban programme in FY2026 BE, compared to FY2025 RE, should aid the affordable segment. Further, the introduction of a second tranche of SWAMIH Fund of Rs. 150 billion is likely to provide much-needed liquidity support to the stressed residential projects and support in completion of additional 40,000 housing units.

The ASP for the top seven cities witnessed sustained material hike, 11% each in FY2023 and FY2024 and is further estimated to have grown by 13-15% in FY2025, driven by an increasing share of luxury segment sales along with pricing flexibility for developers, driven by comfortable YTS. ICRA expects the ASP to increase by 3-5% in FY2026.

“The share of the luxury segment to the overall sales has increased from 18% in FY2022 to 32% in 9M FY2025. A similar trend was observed in launches with the luxury segment’s share increasing from 18% in FY2022 to 34% in 9M FY2025. There has been a gradual shift in the overall segment-wise composition with the declining share of the affordable segment and rise in the share of the mid and luxury segments to the overall sales across the top seven cities. This trend is driven by an increasing desire for house ownership along with evolving buyer preferences for larger homes and upgrading to higher-quality properties,” Reddy added.

ICRA maintains a Stable outlook on the residential real-estate sector. Given the consolidation in favour of larger and established players in the sector, the performance of these players is anticipated to outperform the broader underlying industry trends. The average leverage of these players, as measured by gross debt/cash flow from operations (CFO), is expected to remain comfortable in the range of 1.50-1.60 times in FY2025 and FY2026, supported by a healthy CFO.