The insurance industry faces a looming workforce shortage, with the U.S. Bureau of Labor Statistics projecting a deficit of nearly 400,000 workers by 2026, while professionals continue to spend up to 80% of their time on tedious paperwork and data entry. Traditional automation tools have fallen short, relying on rigid workflows and APIs that break down with even minor process changes, leaving insurance operations burdened with inefficiencies. Kay.ai eliminates manual data entry across submissions and servicing workflows with AI co-workers designed specifically for insurance brokers and agencies. The company’s propreitary technology understands insurance processes, interacts directly with existing tools, and adapts to specific preferences, allowing users to simply forward an email or upload a PDF and have Kay extract key details, enter data across carrier portals, and generate quotes without complex integrations. Early partners are already seeing dramatic efficiency gains, with time savings of two hours per application at a quarter of the cost and workflow automation completed in under two weeks compared to months-long API integrations.

AlleyWatch sat down with Kay.ai CEO and Founder Vishal Rohra to learn more about the business, the company’s future plans, recent funding round, and much, much more…

Who were your investors and how much did you raise?

We raised $3M in seed funding, and the round was led by Wing VC, with participation from South Park Commons, 101 Weston Labs, and several strategic angel investors.

Tell us about the product or service that Kay.ai offers.

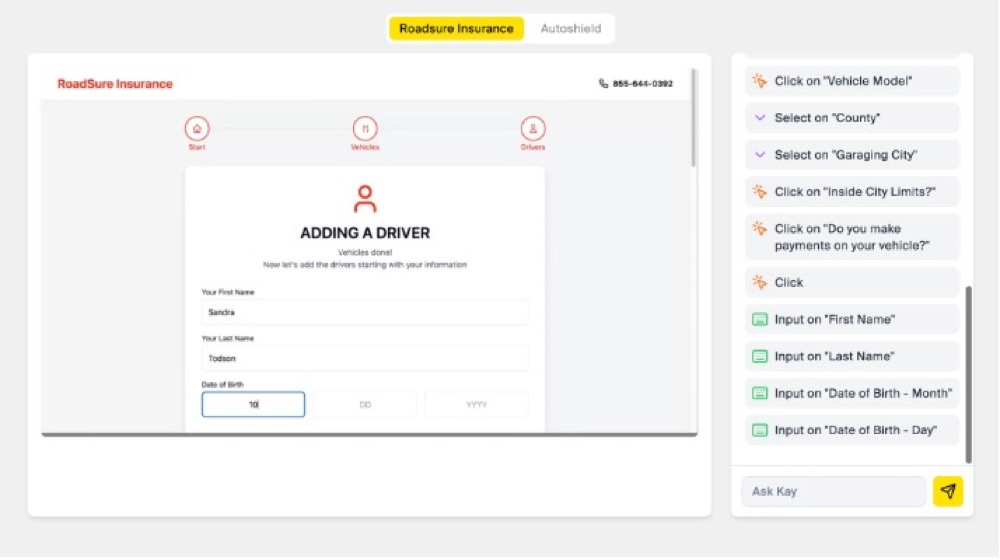

We’ve built AI co-workers designed specifically for insurance brokers and agencies to eliminate manual data entry work across submissions and servicing. Our AI understands insurance workflows, interacts with their existing tools, and adapts to specific preferences. This eliminates hours of manual data entry every day for account managers and service teams – users can simply forward an email or upload a PDF, and Kay extracts key details, enters data across carrier portals, and generates quotes or complete service requests without requiring lengthy onboarding or complex integrations.

What inspired the start of Kay.ai?

My cofounder Achyut Joshi and I are both machine learning engineers with backgrounds at big tech companies. After participating in the South Park Commons Fellowship, we explored various AI applications before recognizing a massive efficiency gap in insurance back-office operations. We actually started this journey at an insurance conference in New York, where we got to interact with 100s of insurance professionals under one roof. It quickly became clear to us that language models were a major inflection point, capable of drastically changing how admin work gets done in this space. We were beyond excited with what was possible, and shipped our first prototype a week later.

My cofounder Achyut Joshi and I are both machine learning engineers with backgrounds at big tech companies. After participating in the South Park Commons Fellowship, we explored various AI applications before recognizing a massive efficiency gap in insurance back-office operations. We actually started this journey at an insurance conference in New York, where we got to interact with 100s of insurance professionals under one roof. It quickly became clear to us that language models were a major inflection point, capable of drastically changing how admin work gets done in this space. We were beyond excited with what was possible, and shipped our first prototype a week later.

How is Kay.ai different?

Unlike traditional software or legacy RPA tools that rely on APIs and rigid workflows that break when processes change, Kay learns and operates like an actual team member. Our AI co-workers understand your process, interact with your tools on your behalf, and adapt with your preferences. This allows us to automate a range of workflows across submissions, renewals, and servicing that couldn’t be automated before. Our early partners are already seeing major efficiency gains – saving two hours of quoting time per application at a quarter the cost, automating workflows in under two weeks (compared to months-long API integrations), and eliminating manual errors while improving quoting accuracy.

What market does Kay.ai target and how big is it?

We’re targeting the insurance operations market, particularly brokers, agencies, MGAs, and carriers who are burdened with manual data entry and paperwork. We’re also tapping into the $300 billion Business Process Outsourcing (BPO) market, where enterprises currently outsource high-volume, repetitive tasks but struggle with high employee turnover, slow turnaround times, and costly human errors.

What’s your business model?

AI coworkers flip traditional SaaS user-based pricing on its head. It’s not just software, it’s a set of teammates that seamlessly operate across your existing tools. Our pricing directly aligns with the value we create for every task we automate. We typically reduce administrative spend by around 80% for each workflow automated, creating clear, measurable ROI for customers.

How are you preparing for a potential economic slowdown?

While we’re strictly focused on growth, our model inherently supports strong cash flows and efficiency. The insurance industry faces a 400,000-worker shortage, so we believe the demand for intelligent AI solutions like ours will remain strong, even in challenging economic climates.

What was the funding process like?

We started at South Park Commons, a vibrant community of builders, former founders, and people experimenting through the earliest stages alongside us. This network provided invaluable support, mentorship, and connections. Once we found conviction in our direction, we quickly raised a round by talking to people we already knew in the industry. Our investors chose to back us because they believed in the team before anything else.

What are the biggest challenges that you faced while raising capital?

The funding process for this round was relatively smooth. For us, the primary focus was on finding the right partners who believed in our vision, were in it for the long term, and could support us through both highs and lows.

What factors about your business led your investors to write the check?

Our investors felt that Achyut and I bring a unique combination of deep machine learning expertise and a relentless focus on product usability, which positions us to redefine how insurance work gets done. The massive operational bottlenecks in the insurance industry, combined with the growing labor shortage, created a compelling case for our solution.

What are the milestones you plan to achieve in the next six months?

Our primary focus is growth. We are rapidly onboarding more customers, expanding across additional workflows, and building a strong in-person team in NYC.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

Stay prudent with your funds and only scale when you’ve reached clear conviction on your product-market fit. Today’s AI tools enable startups to stay lean and accomplish more than ever before. Focus relentlessly on what moves the needle and cut out all the other noise.

Where do you see the company going in the near term?

In the near term, we’re focused on expanding our AI co-worker capabilities to handle more complex insurance workflows beyond quoting. Our goal is to help our customers eliminate operational inefficiencies across their entire business, from submissions to renewals and servicing. We believe our technology will redefine how insurance work gets done, allowing professionals to focus on high-value activities while our AI handles the repetitive tasks.

What’s your favorite spring destination in and around the city?

Domino Park in Williamsburg. It’s right by our office. Come join us for some beach volleyball!