Ever wonder how “alive” the Ethereum network truly is? It’s not just about the number of ETH in existence, but how actively that ETH is being used within its digital ecosystem. This is where the idea of velocity comes in, similar to the well-known concept about the velocity of money.

Think of it like the economy of a bustling city. A high velocity of money means cash is constantly changing hands, fueling businesses and growth. Similarly, the velocity of ETH measures how frequently Ether moves within the Ethereum landscape. Whether it’s being traded on decentralized exchanges, used to interact with smart contracts, paid as gas fees, staked to secure the network, or bridged across different layers, each movement contributes to its velocity.

This metric gives us a powerful insight into the dynamism and overall health of the Ethereum network, reflecting its real economic activity far beyond just the price of ETH.

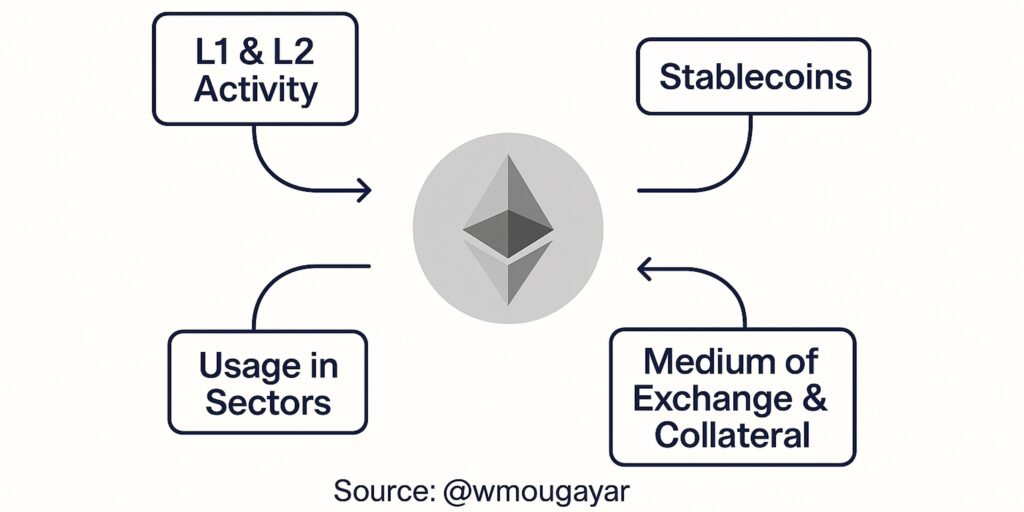

The Ethereum ecosystem isn’t a single entity; it’s a vibrant collection of interconnected layers and applications, and ETH is the lifeblood that flows between them:

-

Layer 1 & Layer 2 Activity: ETH acts as the anchor for the entire system. It moves from the main Ethereum Layer 1 to faster, cheaper Layer 2 networks like Arbitrum, Optimism, and Base, allowing users to transact with lower fees and higher speeds. Crucially, these Layer 2s often send ETH back to Layer 1 for settlement and security, reinforcing Ethereum’s foundational role. Every time a user bridges ETH to explore a new decentralized application (dApp) or participate in a yield-generating strategy on a Layer 2, they’re increasing ETH’s velocity across these interconnected realms.

-

Usage Across Diverse Sectors: ETH isn’t confined to one corner of the crypto space. It’s the common currency across a multitude of thriving sectors:

-

DeFi (Decentralized Finance): ETH is the workhorse of DeFi, used as collateral to borrow and lend assets on platforms like Aave and Maker, and actively traded within liquidity pools on decentralized exchanges.

-

Stablecoins: Many stablecoins rely on ETH for their creation or redemption, and ETH often forms key trading pairs, further embedding its utility.

-

NFTs (Non-Fungible Tokens): From art to collectibles, ETH is the primary currency for buying, selling, and even paying royalties for NFTs, creating significant economic and cultural flows.

-

RWAs (Real-World Assets): As traditional assets like tokenized real estate and treasury bills find their way onto Ethereum, they often settle in ETH, bridging the gap between traditional finance and the decentralized world.

-

The Fundamental Utility: Beyond specific applications, ETH serves crucial foundational roles:

-

It’s the gas that powers the network, paying for every transaction and smart contract execution.

-

It acts as a fundamental layer of collateral, not just in DeFi but also within the core mechanics of the Ethereum protocol itself.

-

Its role in facilitating cross-chain bridging and settlement highlights its versatility as a currency that transcends individual blockchain boundaries.

Understanding the velocity of ETH provides valuable insights into the network’s health:

-

High Velocity = A Productive Ethereum: When ETH is moving frequently, it signifies a vibrant and active ecosystem. It means ETH is being utilized across various dApps, by numerous users, and across different protocols, driving transaction fees, increasing its utility, and ultimately contributing to value creation within the network. This constant circulation is the engine of Ethereum’s economic throughput.

-

Low Velocity = Potential Parking or Hoarding: Conversely, a lower velocity might indicate that more ETH is being held in wallets, locked in staking contracts, or parked for longer-term appreciation. While this can signal strong belief in Ethereum’s future value and reduce the circulating supply, it could also suggest less short-term economic interaction and fewer opportunities for ETH to be used in the immediate term.

The interplay between these high and low velocity dynamics reveals the multifaceted nature of ETH within the broader crypto economy.

In traditional economics, assets with high velocity often function as currencies, liquid and actively circulating. Assets with low velocity tend to act more as stores of value, held onto for the long term.

What makes ETH particularly interesting is its ability to balance both roles. A significant portion of ETH is locked in staking and held in long-term investments, akin to a digital store of value. Simultaneously, vast amounts of ETH are constantly flowing through dApps and protocols, acting as a dynamic currency within its ecosystem.

This unique dual nature positions ETH not just as another cryptocurrency, but as the very heartbeat of a modular, programmable, and increasingly global financial system. By understanding its velocity, we gain a deeper appreciation for the constant activity and potential that lies within the Ethereum network.