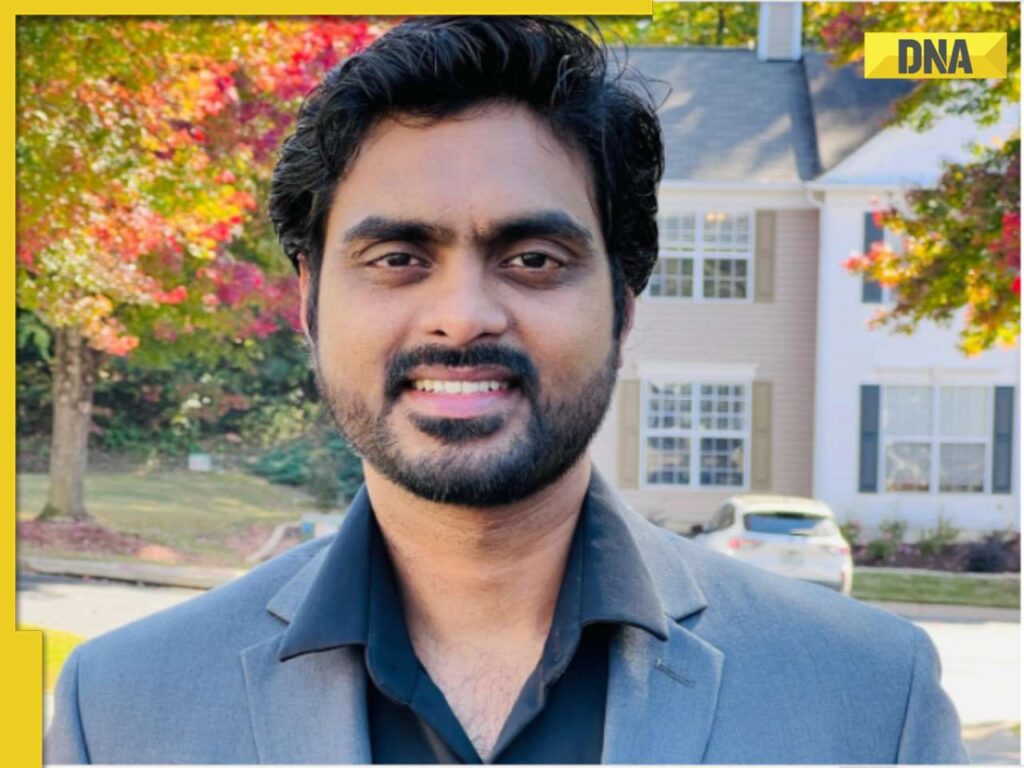

Before there was the barter system then came money in the form of papers and coins, now in the rapidly evolving digital world which is also changing the financial landscape, we have online transactions, transitioning from traditional point-of-sale systems to software-based payment. Participating in this change is Rajesh Kotha, a Software Development Engineering Advisor at Fiserv, whose work in SoftPOS (Software Point-of-Sale) technology contributes to the current trend of contactless payments.

Before there was the barter system then came money in the form of papers and coins, now in the rapidly evolving digital world which is also changing the financial landscape, we have online transactions, transitioning from traditional point-of-sale systems to software-based payment. Participating in this change is Rajesh Kotha, a Software Development Engineering Advisor at Fiserv, whose work in SoftPOS (Software Point-of-Sale) technology contributes to the current trend of contactless payments.

Rajesh was recognized with multiple Living Proof Awards for his contributions to SoftPOS (Software Point-of-Sale) solutions for both iPhone and Android devices across multiple regions, including the United States, Asia Pacific, and Latin America. One of his most notable achievements has been the launch of Tap to Pay on iPhone via the CloverGo App, which empowers individuals to make seamless, contactless payments.

All these developments make a phone transform into a digital payment device. Additionally, he played a critical role in designing the end-to-end cryptography (the algorithms involved in making the code readable only by an authorised source) involved in this project. He was also involved in developing the Finserv SDK and backend Services for enterprise merchants, which significantly increased gross processing volumes for major clients.

The impact of Rajesh’s contribution to making payment contactless was seen at a leading music retailer, where the successful launch of the Tap to Pay solution, across more than 100 U.S. locations has facilitated an annual Gross Processing Volume exceeding $200 million.

The implementation of the Tap to Pay also led to a 25% savings on hardware costs for many clients, offering a cost-effective and flexible mode of payment for many clients.

Plus, another significant thing that Rajesh was engaged in was the development of a reusable framework and standardized APIs for Tap-to-Pay solutions, resulting in a 20-30% reduction in deployment time for new merchants and regions. This streamlined approach has enabled merchants to rapidly adopt contactless payment solutions meeting evolving market demands with greater agility, this easy adaptability meant the user base of the software increased rapidly.

However, changing from a hardware system to a software included many challenges, such as ensuring compliance with stringent payment security standards, for which good cryptography techniques, robust encryption protocols and leveraging best security industry practices were implemented.

Also, there was the need for rigorous scalability testing to ensure that the app could handle a huge volume of transactions, which was ensured via continuous performance tuning and stress testing. Further, initiating any change will be met with resistance. By offering intuitive user interfaces and detailed onboarding support plus reassurance, they ensured a smooth transition and high merchant satisfaction.

Rajesh’s work extends beyond mere implementation to shape the theoretical framework of modern payment systems and security, as documented in his recent research paper, “An In-Depth Knowledge on EMV Tags and Their Adoption in FinTech and Traditional Banking.” His contributions to the field are outlined in several other published works, including comprehensive analyses of mobile payment solutions and security architectures.

Further, looking at the current trends, Rajesh tells us that the payment landscape is being reshaped by the rapid adoption of software-based solutions like SoftPOS driven by consumer demand for seamless easy transactions. Further, there is also a convergence of payment systems with loyalty programs to enhance customer engagement and insights and the adoption of AI and ML for fraud detection and for providing personalized experiences. Plus, he talks about the potential of blockchain to enable faster, transparent, and cost-efficient cross-border transactions.

For businesses trying to ride this wave, Rajesh has some suggestions. He tells us that businesses should adopt agile methodologies to stay responsive to technological and regulatory changes, prioritize scalability to handle growing transaction volumes, forge partnerships with banks and fintechs to enhance solution capabilities and invest in user education to ensure the adoption of innovations like SoftPOS. Further, he tells us that there is a need to balance security with user-friendly features to thrive in this tech-finance environment.

Through his leadership and work in payment technology, Rajesh Kotha continues to float the current of digital transactions, creating solutions that combine security, efficiency, and accessibility for businesses worldwide. His experiences can serve as a guide for businesses trying to digitise their payment systems.