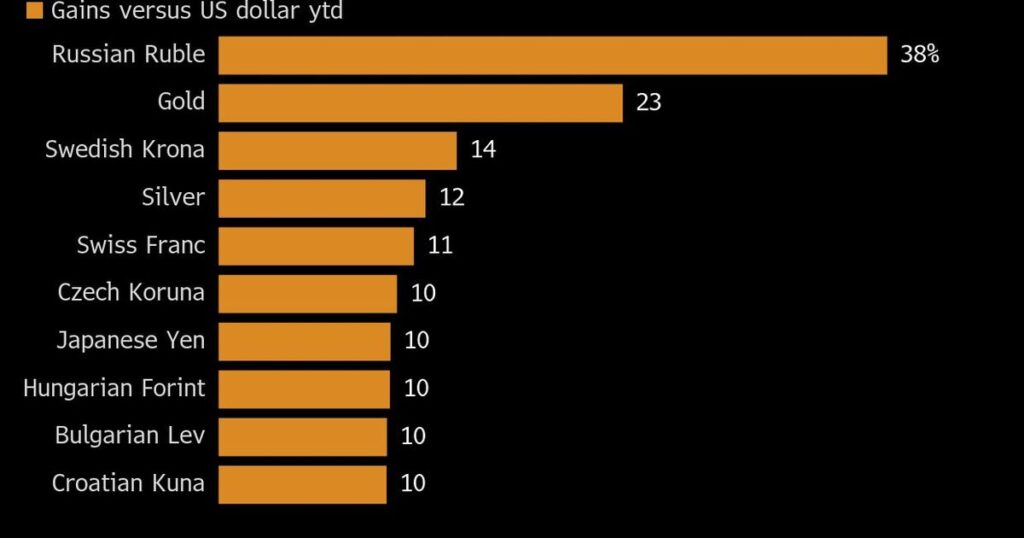

(Bloomberg) — Russia’s ruble has surged to become the best performing global currency, posting this year’s strongest gains against the dollar to outpace even the traditional safe haven of gold.

The ruble has strengthened 38% versus the dollar on the over-the-counter market since the beginning of this year, data compiled by Bloomberg shows. While the greenback has reeled from mounting pressure caused by US President Donald Trump’s escalating tariff wars, Russia’s currency has also been buoyed by factors unique to the country, including record-high local interest rates.

“Unlike many emerging-market currencies, the ruble is not facing pressure from capital outflow, caused by global investors’ retreat from riskier assets,” said Sofya Donets, an economist at T-Investments. “Capital controls have largely shielded Russia from this” while high borrowing costs support the currency, she said.

Domestic factors have amplified the ruble’s gains against the weakening greenback, even as sweeping sanctions imposed by the US and its allies over the February 2022 invasion of Ukraine remain in place. While a strengthening currency may be welcome news for inflation hawks, it risks damping energy revenue when the state is spending massively on military needs and social programs.

Persistent inflation has forced the Bank of Russia to maintain an ultra-hawkish monetary stance — the key rate stands at 21% — that’s curbed demand for imports and, by extension, for foreign money. Meanwhile, exporters are required to sell part of their foreign currency earnings on the local market, further fueling the ruble’s ascent.

A perceived thaw in US policy toward Russia has revived the ruble’s appeal for a classic carry-trade. Foreign investors, undeterred by lingering sanctions risks, are turning to countries that remain on good terms with Russia to gain exposure to high-yielding ruble assets, said Iskander Lutsko, the Dubai-based head of research and portfolio management at Istar Capital.

On the top of that, Russian companies are eager to refinance prohibitively expensive local-currency debt, using much cheaper yuan-denominated loans, which is driving additional conversions of foreign currency into rubles, Lutsko said.

The dollar was propelled to a fresh six-month low on Monday as the Trump administration’s latest back-and-forth on tariff policy added to investor unease toward US assets and undermined confidence that the greenback and Treasuries remain the ultimate risk-free havens.

Traders have flocked to gold as they divested from dollar assets amid expectations of further disruption and uncertainty. The precious metal has climbed 23% since the start of the year to all-time highs, ranking as the second-best performer against the dollar after the ruble.

What Bloomberg Economics says…

“The ruble has benefited from three developments since the start of the year. First, the Putin-Trump thaw has boosted confidence on Russia’s markets and reduced demand for hard-currency assets. Second, tight monetary policy is cooling corporate and consumer demand for imports, increasing the net supply of hard currency. And third, Russia’s government is shielding the economy from the impact of a decline in oil prices by selling hard currency from its National Wealth Fund.”

— Alex Isakov, Russia economist

Still, inside Russia, the ruble has strengthened 19% against the dollar this year to 82.7671 — a smaller gain than what’s reflected in offshore markets, according to figures from the Bank of Russia. The discrepancy stems from a divergence in exchange rates at the end of last year, when the local market was shut for extended holiday breaks while global trading continued.

Dollar trading on the Moscow Exchange remains suspended following US sanctions imposed last summer, pushing such activity into over-the-counter venues. That has complicated price discovery and contributed to a gap between domestic and international pricing.

The ruble’s rally has come as a surprise to the Russian government, which based its 2025 budget on an average exchange rate of 96.5 per dollar, 14% weaker than the current level. The stronger currency coupled with a plunge in oil prices threaten to diminish projected export revenue.

Many analysts have remained cautious. In a March survey by the Bank of Russia, the consensus forecast was for the ruble to average around 98.5 per dollar this year.

The ruble’s appreciation may have been triggered by renewed interest in Russian assets amid an improving geopolitical situation, the central bank said in its summary of the discussion on the key rate. The relatively high benchmark rate in Russia may also have been a factor, report said.

Supportive factors for the ruble are likely to persist in the near term, according to some analysts. “There are no clear drivers for the ruble’s weakening at this stage with a rate cut off the table for the upcoming quarter,” said Lutsko.

More stories like this are available on bloomberg.com

©2025 Bloomberg L.P.